Excess Mortality Report

The Silent Toll: Highlighting the Surge in Non-Covid Excess Mortality Amongst the Young and Exploring Potential Causes

The Pandemic is now a memory, yet non-Covid deaths continue to rise, for reasons the UK’s top healthcare authorities are unable to explain. The UK government’s own data shows Excess Mortality spiked most significantly among young people in 2022 and 2023, and shows a substantial increase in deaths due to heart failure during the same period – in 2023 alone, 7 times more people died unexpectedly, for reasons unrelated to COVID, than died in the single worst night of the Blitz. We provide insights into the excess mortality trends, explore potential causes, and urge a proper and broader investigation of the true root causes.

2024 Resolutions: Means vs. Ends - A Business Leader's Perspective

We’re almost through the first quarter of 2024, and the airwaves are still buzzing with predictions about the major trends that will dominate our business landscape. Consultants, advisors, and thought leaders offer a plethora of “means” to navigate this complex terrain – AI, digital transformation, sustainability… the list goes on. But amidst this information overload, a crucial question arises: are these experts truly addressing the “ends” that matter most to business leaders?

This analysis summarises the major trends identified in various industry publications, providing a comprehensive business outlook for 2024 – the “means”.

Seven Key Themes – The “means”

- Artificial Intelligence (AI): The emergence of Generative AI is a dominant theme, impacting all business functions. Experts emphasise the need for proactive integration of AI at the core of operations, not as an afterthought.

- Economic Landscape: Prolonged high-interest rates and inflation in the first half of the year, coupled with slower progress, necessitate strategic adaptation for businesses to maintain growth.

- Sustainability: Environmental and social sustainability require significant investments. Businesses are urged to accelerate their transition and embed climate change initiatives into their core strategies.

- Talent Acquisition: The ongoing “war for talent” necessitates focused strategies to attract and retain top talent for business success.

- Digital Transformation: Leveraging technology for intelligent automation and digital transformation is critical to avoid falling behind competitors.

- Geopolitical Risks: Potential disruptions due to global conflict are anticipated, impacting supply chains, resources, and energy prices. Companies need to build resilience to weather these challenges, particularly in a year with widespread global elections.

- Data Management: Publications highlight the importance of data as a distinct focus area beyond digital transformation. Businesses should prioritise data security, governance, and utilisation for informed decision-making.

However, our analysis of industry publications reveals a disconnect between the “means” prescribed (above) and the “ends” desired by executives. While the predictions paint a picture of necessary transformations, they often neglect the fundamental question: what do we realistically want to achieve this year?

Executives crave practical guidance on achieving specific outcomes, not just a list of challenges and technologies.

The “ends”

Here’s a closer look at the “ends” driving business leaders in 2024:

- Fit-for-Purpose Operating Models: Businesses need to ensure their core structures are adaptable and efficient in a volatile environment. Leaders must prioritise reforming their operating models, to remain competitive and building a solid foundation before layering on technology.

- Cost Control and Efficiency: Reducing costs and driving efficiency are paramount in a challenging economic climate. While AI promises automation, executives seek immediate solutions like streamlined processes and improved productivity, especially in the post-pandemic hybrid work model.

- Balancing Sustainability and Stakeholder Value: Executives acknowledge the importance of climate change and responsible practices, but concerns about regulatory burdens and cost implications often overshadow immediate action. Strategic investments are prioritised when balancing sustainability with stakeholder expectations.

- Navigating Regulatory Burdens: Overregulation is seen as a major hurdle, adding costs and hindering agility. Businesses seek a more balanced approach that ensures compliance while fostering innovation and customer satisfaction.

- Customer Centricity at its Core: Attracting and retaining customers in a competitive landscape remains a top priority. Businesses must go beyond cost-cutting, focusing on quality, ethical practices, and a seamless customer experience.

- Building Resilience for the Future: Adaptability and robustness are crucial in today’s ever-changing world. Executives see AI and other trends as potential tools, but not the only answer. Nurturing internal innovation and building resilience across all dimensions is key.

The takeaway? Business leaders are actively strategising, but they prioritise practicality and outcomes over theoretical trends. They crave guidance on how to achieve their specific goals, not just a list of “what” to do. In this uncertain environment, focusing on building capacity, formulating clear strategies, and delivering tangible results will be key to success.

So, what about you? Are you focusing on the “means” or the “ends” in your 2024 resolutions?

CONTACT US TO FIND OUT HOW WE CAN HELP

Navigating the future: AI's impact on wealth management firms

In recent months, the financial services industry has witnessed significant advancements in artificial intelligence (AI), sparking both excitement and apprehension amongst wealth managers. While the potential benefits of AI are undeniable, the wealth management sector has been understandably cautious in embracing this transformative technology. This hesitation can be attributed to several factors, including a prioritisation of addressing critical gaps in services, concerns about client relationships, and the unique needs of different market segments.

In this blog, we explore the hopes and fears of integrating AI in wealth management, balancing the potential savings and efficiencies that can come from technological advancement alongside the concerns over an erosion of personalised client services.

Back office transformation

The potential for improved efficiency through AI and machine learning is substantial, particularly in areas like automating trade settlements, automating regulatory compliance, and risk management.

However, within the technology function of many wealth management firms, the primary focus often relates to implementing new traditional services and upgrades to address key operational gaps. Implementing non-AI solutions to enhance services such as regulatory compliance, Environmental, Social, and Governance (ESG), Customer Relationship Management (CRM), and digital services are typically considered more important and lower risk.

Because of the potentially significant benefits and the remarkable pace of change in AI, we believe that wealth management firms should put aside time and budget in 2024 to carefully evaluate the potential efficiencies and cost savings offered by AI, balancing these against the benefits of their current project portfolio. This assessment will help determine if prioritising AI integration is a strategic move that aligns with their operational goals.

Front office dilemma

We are starting to see the emergence of more AI-powered tools that can transform the front office experience for wealth managers and their clients. Early adoption of these innovations has the potential to allow client advisors and relationship managers to better serve “mass affluent” clients. Use of AI in this environment could combine the advantages of a human-led personalised service and advisor judgement with the scalability and insights that AI can provide.

However, implementation of AI in the front office remains a challenge. Securing funding to develop new AI capabilities requires proof of value to the organisation and clients. Wealth managers must also weigh up the benefits against factors such as data and integration challenges, evolving financial services regulations for AI, and the perceived lack of trust from clients in insights generated from AI.

Industry evolution

We believe a small number of early adopting wealth managers armed with AI capabilities are likely to start disrupting the industry at some point in the next year. Developing a strategy, plan, and business case for AI integration is important to avoid being left too far behind.

Key considerations

- Early adoption dilemma: The decision to be an early mover or a follower with respect to AI in the wealth management market needs careful consideration of the associated risks and rewards.

- Barriers to progress: For those who decide to invest in AI, there are some foundational elements that could act as barriers to AI progress if not addressed:

- Data governance and quality: Building a foundation of sound data governance and ensuring data quality is imperative for effective AI implementation. This discipline is important in any organisation but vital to get the best out of AI solutions.

- Robust data infrastructure: Modern platforms with adaptability to change swiftly are most suitable to form the backbone of successful AI integration.

- Skilled resources: The availability of appropriately skilled individuals is critical for navigating the complexities of enterprise AI.

Conclusion

As the wealth management sector contemplates the role of AI, a delicate balance must be struck between embracing innovation and preserving the personal touch that defines many client relationships. While challenges exist, we believe that the potential rewards in terms of cost savings, productivity gains, and enhanced client experiences will make the journey towards AI integration worthwhile. Wealth managers should consider their strategy for when and how to look at the opportunities that AI can provide for them to ensure that they don’t fall behind their competitors.

CONTACT US TO FIND OUT HOW WE CAN HELP

Driving Strategic Impact: A Curzon Consulting Guide to Procurement Excellence

As management consultants, we help clients achieve substantial cost savings and efficiencies through procurement transformations. But truly effective transformations require surmounting common challenges like limited spend visibility and stakeholder alignment.

Based on a recent engagement delivering over £5M in savings, here are our proven tips for procurement transformation success:

Optimise spend visibility

Robust spend analysis is crucial. Categorise expenditures and pinpoint top suppliers and contracts per category. Without clean baseline data, it’s impossible to identify savings levers. Advanced analytics and mining uncover hidden insights, while stakeholder interviews provide a qualitative context.

Benchmark and identify gaps

Benchmark pricing and performance versus industry best practices to reveal overpayment. Consolidate volumes for improved leverage. Deep supply market analysis uncovers alternative vendors and guides negotiations.

Strategise and priortise

Conduct opportunity assessments to inform transformation planning. Develop tailored category-specific sourcing strategies. Model potential savings scenarios and sequence initiatives based on impact, effort, and stakeholder readiness.

Secure stakeholder alignment

Amidst change, align stakeholders through clear communication and early buy-in. Identify key decision-makers and influencers. Educate on best practices and projected bottom-line impact. Procurement must shed its tactical image and be seen as a strategic function driving millions in bottom-line impact.

Relentlessly implement

With the strategy set, focus intensely on implementation. Maintain discipline in negotiations while preserving supplier relationships. Enforce contract compliance and tail spend management.

Continuously improve

Sustaining change requires continuous improvement. Redesign operating models, policies, KPIs, training, and integrate new tech and ways of working. Build analytics to monitor savings and flag waste recurrence. Institutionalising change is the hallmark of procurement leaders.

After meeting our cost-savings goals, we leveraged our award-winning assessment framework to ensure the procurement organisation’s long-term success. Our framework evaluates Procurement across five dimensions: People, Strategy, Systems, Governance, and Management. This data-driven approach identified gaps and enabled us to strategise implementing best practices. Ultimately, these steps addressed challenges, so the procurement organisation can expand its influence and be viewed as a strategic partner across all business units.

In conclusion

As trusted consultants, we overcome inertia and silos to deliver rapid yet lasting transformation. With deep expertise and cross-industry perspective, we objectively assess opportunities, align stakeholders, and implement best practices. The result is simplified sourcing, lower costs, reduced risks, increased efficiency, and strategic impact.

Let us conduct an initial diagnostic for your procurement organisation. We will benchmark performance, identify savings levers, and provide a roadmap to deliver value.

CONTACT US TO FIND OUT HOW WE CAN HELP

Can charging supply keep pace with electric vehicle demand?

Net-zero carbon emissions by 2050…

Electric vehicles (EVs) are increasingly heralded by nations across the globe as a vital part of the net-zero transition to reduce emissions, and the key technology for decarbonising transportation, which accounts for 13% of emissions globally. But whilst vehicle sales have been booming in recent years, the installation of charging networks that underpin EV usage are trailing dangerously behind. The extent of this lag is particularly concerning in the United Kingdom (UK) where it poses a fundamental threat not just to the continued growth of the EV market, which by the end of 2023 is projected to be worth £16bn, but it threatens any plans for the UK to reach net zero carbon emissions by 2050.

A global EV boom driven by three central influences

Such has been the drive to increase the uptake of EVs, that global sales of Battery EVs (BEVs) and Plug-In Hybrid EVs (PHEV) doubled in 2021 from the previous year, and 2022 saw a +55% increase in global EV sales over ‘21. The registration of 10.5 million new vehicles in ’22 was despite component supply chain shortages and disruptions from the war in Ukraine that hampered output. With approximately 27 million EVs on the road today, they now account for a global market share of 13% of vehicles on the road.

What is clear is that as global consumers increasingly align their climate-driven values with vehicle purchasing, the number of EVs on the road will continue to rise exponentially. This is an ‘EV boom’ that has been accelerated by a combination of three central influences:

- Sustained governmental policy support, in the form of subsidies and incentives, pledges to phase out internal combustion engines (ICEs), and lofty electrification targets

- The rise in the availability and performance of EV models, which now gives consumers five times as many to choose from than in 2015

- Electrification of fleets by car manufacturers, in a race to meet rising consumer demand.

Showcasing the innovations and ideas behind EV market growth

The annual London EV show and conference, held at the end of November ‘22, is a platform where stakeholders from all three market influences gather to showcase the innovations and ideas that are spearheading the UK EV transition. With representation from the entire value chain, this year’s event included collaborations between government representatives, fleet management, charging systems & solutions providers, battery technology providers, major car manufacturers, and other influential stakeholders.

Attending the show provided me with a ‘peak-under-the-bonnet’ of the UK EV market and shed light on some of the key trends emerging in 2023 and beyond. Conference talks included those from industry leaders and leading research centres, amongst the latest vehicle innovations being showcased. These talks had one key common theme – that whilst a marketplace as dynamic as EVs offers great opportunity, commercially and in tackling climate change, capitalising effectively on these opportunities over the next few years will be fraught with challenge for the UK.

UK charging infrastructure is struggling to keep pace with the EV growth

The London EV show highlighted just how much the UK EV market has expanded in recent years in line with global growth, notching up an impressive 92% increase in EV registrations between January ‘21 and January ‘22.

UK charging, however, is still in its infancy relative to the vehicles it powers, and comparatively lags behind. There is a growing disparity between the growth rates of EV sales in the UK and charge point installations. This divergence threatens to impede the UK from meeting climate-goals set by the government and derail the feasibility of the UK’s ban on internal combustion engines (ICEs) that looms in 2030.

When you compare the absolute number of public charge point installations the UK needs to support the proposed transition, with current figures, it is clear there is still a long way to go. If the government’s 2022 charging infrastructure strategy successfully meets its ambition, by 2030 there should be over 300,000 public chargers installed nationwide. In comparison, as of January ‘23, there were cumulatively just 38,000 public charge points available across the UK.

More importantly, though, is considering the pace of charger installations relative to new EV registrations – which is slowing owing to the continued acceleration of new EV registrations. Since January ‘20, the cumulative number of EVs in the UK has increased 3.8X, whereas the number of charge points has increased just 2.6X. This increasing disparity is made ever clearer by the change in the UK’s EV-to-charge point ratio – a measure which helps assess the suitability of a nation’s charging network to support its vehicle’s needs.

As a benchmark, the Alternative Fuel Infrastructure Directive (AFID), an EU policy which regulates the deployment of public chargers, recommends a ratio of 10 EVs per public charge point for EU member states.

In 2016, the UK had a healthy ratio of approximately 8 EVs per charge point. Comparatively, the UK now has the 9th worst global ratio of 21 EVs per public charge point. There are evidently key lessons to be learned from the likes of South Korea, the global leader which boasts a ratio of just 2.6.

Unlocking mass adoption with public charging infrastructure

The vehicle-to-charger gap poses a fundamental problem to the mass adoption of EVs in the UK, for two main reasons. Firstly, on average, 30% of UK households lack off-street parking for residential charging. This figure rises to around 40% across major UK cities, and as high as 50% in London. These households will therefore have to rely on the public charging network – either off-street slow, charging, or nearby fast/rapid charging hubs – to charge their vehicles at home.

This scenario works, provided there are enough charge points to accommodate users. However, too few chargers pose a major barrier for drivers switching over from ICEs, who will view EVs as impractical until there is somewhere suitably convenient to charge them.

When Which? surveyed 1.5k electric car owners, nearly half said that their nearest public chargers were over a 20-minute walk away.

Not exactly convenient.

The logic is the same looking across the UK’s charging network for longer journeys. For true mass adoption, there needs to be enough charge points to make charging your vehicle battery as convenient as filling up with fuel currently.

Speak to any EV owner in the UK, however, and they will tell you of the growing issues around public charging: long queues, a myriad of payment systems and apps to contend with for different charge-point-operators, and chargers which simply don’t work (experienced by 4 in 10 customers of public EV chargers).

This is not conducive to convincing the masses to switch from ICE vehicles to the more sustainable option of electric.

These issues with the charging infrastructure will continue to exacerbate as drivers become increasingly reliant on public chargers, versus at home or work, the more that make the switch to EVs. The UK urgently needs to accelerate its plans for large-scale installations across the public charging network, which is so far failing to deliver the c.100 installations per day needed until 2030 – last month (Jan ’23) just 28 charging devices were installed per day. A large-scale programme such as this requires a unified drive from all stakeholders.

As demand and supply continue to fall out of balance, this situation presents opportunities for private investment in the expansion of the charging networks. The current EV charge point operator market is highly fragmented and lacks a ‘gold-standard’ of consumer vehicle charging. There is a clear market need that so far appears unfulfilled in both availability and quality.

Whilst there are a multitude of other challenges that must be addressed, such as ensuring a sufficient supply of electricity to meet charging demands, each of these challenges offers their own commercial opportunities.

For those considering entering or expanding within the space, now is the time to answer the key strategic questions – what is the ‘Size of the Prize’ available? Which of the current barriers-to-adoption offer the greatest opportunities if addressed effectively, and how can that value be harnessed?

Milo Eadie

Milo is a strategist and transformation consultant with experience across capital projects, electric vehicle fleets and charging infrastructure, and product development. He began his career as a design engineer in the nuclear industry, where he consulted on the UK's fleet of reactors.

His expertise includes business strategy, data-driven decision making, productivity optimisation, and applied innovation and implementation. He is passionate about combining these skills to support clients in achieving their Net-Zero ambitions.

Milo is a Master of Engineering (MEng, Hons) from the UK’s leading General Engineering course at the University of Bristol, where he gained specialisms in Sustainability, Project Management and Entrepreneurship.

CONTACT US TO FIND OUT HOW WE CAN HELP

Recessions are easy to forecast, so how can CEOs better prepare to weather the economic storm?

‘A rising tide lifts all boats’ is an aphorism associated with the idea that good CEOs can drive business growth during the good times. However, in my experience…

exceptional CEOs drive remarkable growth during economic downturns!

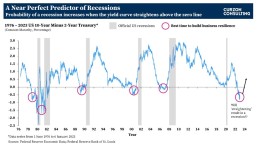

No matter what anyone tells you, recessions are easy to forecast. It’s the severity of the recession that is difficult to predict. One of the most watched charts in economics is the 10-year US treasury interest rates minus the 2-year US treasury interest rates (a.k.a. Yield Curve chart), which has a near-perfect record of forecasting recessions. The yield chart is currently flashing a ‘code red’ highlighting a recession is highly likely within the next 12-18 months. However, it is not all doom and gloom!

Smart CEOs can leverage the yield curve date to ensure their businesses are fortified to weather the upcoming economic storm. As shown on the chart, building financial and operational resistance should be a key priority of executives whilst the yield curve remains inverted!

What is yield curve inversion, and why does it matter?

To simplify… the chart shows the 10-year US treasury interest rates minus the 2-year US treasury interest rates. In a normally functioning economy, the longer the bond maturity, the higher the interest rate (yield) demanded by investors. Investors seek higher returns on longer maturing binds as risks become more difficult to anticipate the longer the term extends into the future.

However, when investors are worried about the economy, they get concerned with the ‘here and now’. Therefore, investors demand higher interest rates on short-term maturities; hence, an inversion between the 10-year and the 2-year interest rates takes place.

An inversion occurs when the 10-year US treasury interest rate minus the 2-year US treasury interest rate falls below zero.

Pre-1990s, recessions were recorded whilst the yield curves were inverted (i.e. below the zero line). Post-1990s, all recessions were recorded after the yield curves straightened (post the initial inversion).

As of 6th January 2023, the yield inverted at -0.69. This inversion is flashing a major warning signal! If history repeats again, there is likely to be a recession once the yield curve straightens again.

The question is… how deep will the recession be? That’s hard to forecast, but the current inversion rate is much deeper than what we’ve post-1990. If the inversion continues to deepen similar to the early 1980s, we could potentially see a large recession following.

So what?

As highlighted on the chart, the best time to start a business transformation programme and build financial and operational resilience is when the yield curve is inverted and well BEFORE it straightens again (i.e. rises above the zero line).

CEOs and CFOs should utilise the yield curve chart to kick start or accelerate an existing business transformation programme, well before a recession arrives.

If you are interested in learning more, please get in touch

CONTACT US TO FIND OUT HOW WE CAN HELP

Sustainable Construction Innovation, Does it matter?

The transport construction industry has significant opportunities to reduce carbon by developing materials with lower embedded carbon. Producing cement uses a great deal of energy, so finding a waste product that can substitute for cement makes good environmental sense, while concrete is always at the top of construction sites carbon emissions. Pulverised Fuel Ash, PFA, is a by-product of coal-burning power stations. The ‘ash’ is recovered from the gases and used, amongst other functions, as a cement substitute. This will reduce CO2 by reducing cement through the increased use of cement replacement and increased use of recycled aggregate.

This positive change is one of the most common ways that businesses innovate, and one used to innovate frequently. Cement product innovations play a significant role in the transition towards carbon net-zero emissions across construction industries.

The network of universities, cCatapults, and grant funding allows businesses to embrace innovation and provide more high-value services that change the industry’s innovation capability. There is unprecedented investment and attention by Government, customers and business to advance innovation capability to deliver new business outcomes that will redefine collaborative relationships across the supply chain, increase repeat business with customers and demonstrate that the industry is not a commodity and cannot be procured solely on price. What is delivered is complex and requires highly skilled people to look at delivering the best solution.

Please contact andrew.wilson@curzonconsulting.com or take a look at Curzon Consulting’s sustainability website

References:

GreenSpec. Building Design.

About the author

Andrew Wilson

Andrew is a seasoned strategy and transformation consultant with experience across Africa and the UK.

His background is in capital projects, energy, mining and sustainability. He has a passion for the crossover between productivity, growth and sustainability, complemented by his qualification from Cambridge University in Business and Climate Change: Towards Net Zero Emissions.

Andrew has built mines, towns, roads and power plants, and he aims to keep building using a sustainability lens.

Which risks are the most challenging to carbon net-zero in Africa?

There is a ‘ ticking timebomb’ in third-world countries where there is heavy reliance on fossil fuels (coal burning) for electricity and is responsible for between thirty to/forty per cent of employment. In the particular case of Africa, tThe continent is embarking on a massive expansion of fossil fuel electricity. More than 200 new power stations are planned, the majority of which will burn coal (Pollutionwatch, The Guardian). However, Africa is uniquely positioned to leapfrog dependence on fossil fuels and utilise abundant renewable resources such as solar and wind. Government legislation to reduce this dependency would see joblessness leading to hunger, civil unrest and a potential change of government at the ballot box. Trade Unions are very strong in these sectors due to human rights abuses for tens of years. For change to happen, there is a tricky hierarchy of political players to be satisfied and included before any legislation would be agreed and implemented.

What business opportunities could be related to the African net-zero transition?

Many of the countries mentioned above have very high temperatures, which provide strong sunlight. This raises solar panel opportunities. The countries are also vast and tempting medium-term investment options for wind turbines as their manufacturing costs drop and returns increase as populations grow and require electrification. Fossil fuel companies need to start investing in renewable energies to continue making positive revenue margins and balancing their emissions to carbon net-zero.

Social or economic network effects?

There are extreme views against fossil fuel companies, often with headquarters in European countries. Social media highlights these emission concerns and provides a platform to disseminate important emission information and gather people to attend anti-emissions rallies.

Contact me at www.curzonconsulting.com to discuss further.

About the author

Andrew Wilson

Andrew is a seasoned strategy and transformation consultant with experience across Africa and the UK.

His background is in capital projects, energy, mining and sustainability. He has a passion for the crossover between productivity, growth and sustainability, complemented by his qualification from Cambridge University in Business and Climate Change: Towards Net Zero Emissions.

Andrew has built mines, towns, roads and power plants, and he aims to keep building using a sustainability lens.

Why renewable energy is fuelling investor interest?

Renewables will represent 80% of the total share of investments in power generating capacity from today to 2050. Global energy needs are expected to grow by 30% between today and 2040.

As an asset class, renewable energy has matured dramatically over the past two decades. It has gone from being seen as an alternative culture to having huge investment potential. At the same time, traditional investment norms are changing and not just because of the evolving sustainability mega-trend. In recent years, investment managers have increased their allocations to the broader real assets sector with growing numbers classifying infrastructure and real estate as “real assets”.

Solar power does not pollute the air with greenhouse gases and is noise-free to be used for residential purposes. Solar opportunities are available at various scales, i.e. for households and large business ventures providing power to the grid. Solar panels are the fastest-growing renewable energy option, thanks to falling costs and increasing investment. Their easy installation and “low emissions” are environmentally friendly.

Wind turbine power will be an increasingly compelling longer-term investment due to increasing urbanisation and population growth, leading to higher electricity demand. Technological progress with relative cost advantages for renewable energies and an improved regulatory environment (social and political support) motivates businesses to manufacture wind turbines.

About the author

Andrew Wilson

Andrew is a seasoned strategy and transformation consultant with experience across Africa and the UK.

His background is in capital projects, energy, mining and sustainability. He has a passion for the crossover between productivity, growth and sustainability, complemented by his qualification from Cambridge University in Business and Climate Change: Towards Net Zero Emissions.

Andrew has built mines, towns, roads and power plants, and he aims to keep building using a sustainability lens.

Why Coupling your Business Plan With Your Decarbonisation Plan is More Effective Than Drafting Them Separately?

There are incredible synergies with aligning purpose and ambition in the decarbonisation sense to the Mission, Vision and Values of the business. Thinking of them in unison will intertwine the business plan (revenue generation) with the decarbonisation plan and allow the business to set short and long-term business goals and decarbonisation metrics. As with most strategy plans, the goals/metrics should be reviewed bi-annually to correct any deviations from the plan.

In the government highway infrastructure sector, the business is aligned to decarbonisation 2050 as legislated by the Paris Agreement 2015 with 2030, 2040 and 2050 time horizons to achieve scientifically based metrics. Collaboration with delivery partners is crucial in reaching these targets. Targets for the delivery partners are aligned to ensuring achieving the business’s Scope 1,2 and 3 targets.

Innovation and collaboration are driving decarbonised materials, electric fleets and whole life design thinking. In other words, it directs a circular economy. Proven technologies and close ties to the government encourage policymakers to be bolder with the legislation they advise politicians to implement. With proven technologies being implemented, financiers are more willing to provide financing.

These innovations provide people who live around major highways with cleaner air and reduced pollution. Less pollution means fewer lung inflictions which ultimately means a healthier society and reduced pressure on the NHS.

About the author

Andrew Wilson

Andrew is a seasoned strategy and transformation consultant with experience across Africa and the UK.

His background is in capital projects, energy, mining and sustainability. He has a passion for the crossover between productivity, growth and sustainability, complemented by his qualification from Cambridge University in Business and Climate Change: Towards Net Zero Emissions.

Andrew has built mines, towns, roads and power plants, and he aims to keep building using a sustainability lens.