Forming the new organisation around purpose

Managing Consultant Rodrigo Quezada Dighero attends Working Futures on 13 November 2019. At this event, they’ll be discussing the challenges HR Directors need to overcome to deliver greater productivity, digital transformation and formalise new strategies around organisation purpose.

HR's changing role

HR’s role now is to deliver the performance, frameworks and environments for both people and systems to allow true business transformation. This requires HR to reorganise itself and to grasp the purpose of the organisation and formalise new strategies around the purpose of the company.

We’ll be attending Working Futures on the 13th November 2019. There we will debate these elements and provide the shift in thinking that HR Directors now need to form the productive organisation.

Challenges organisations face

- Disruptive technologies

- Low entry barriers, new segments served

- Short product lifecycles

- Stress, wider product portfolio, product profitability

- More demanding customer experience

- Customer service, customer journey and customer lifecycle

- Multi-generation workforce – there are now 5 generations in the workforce

The challenges leaders face is how to envision, set and lead a flexible organisation that can quickly adapt and thrive in an ever changing and demanding environment

Creating a flexible and meaningful organisation requires a different approach

Forming strategy around purpose

Purpose:

- Allows peers and management to set a connection towards something bigger than just business profits

- Enables a multi-generation workforce to connect around a greater outcome

- Encourages disruptive design and thinking

- Allows the company to adapt, move and thrive by creating the products and services that best serve clients

- Facilitates flexibility to respond rapidly

- Provides speed to execution and calibration

- Allows people and teams to risk and innovate

- Eliminates silos, fostering interdependence, trust and team work

Many high-growth companies use purpose to generate sustained profitable growth, stay relevant in a rapidly changing world, and deepen ties with their stakeholders.

Targets and incentive plans became cross-functional, designed to build capabilities both within and across businesses. And at every step, purpose helps everybody in the company understand the “why”.

Questions leaders can ask about their organisation

Leaders need to constantly assess and calibrate how purpose can guide strategy, and they need to be willing to adjust or redefine this relationship as conditions change. Questions Leaders and People/HR Directors should be asking are:

- Does your company have a purpose?

- Do your company have a clear vision?

- What drives your company’s vision?

- Is your vision based on a clear purpose?

- Are your plans and projects tightly connected to your purpose and business outcomes?

- Are your people aligned around your vision?

How we can help HR Directors to align the organisation around purpose

- “From There To Here” Design

- Transformational maps

- Pathways definition

- Disruptive design

- Interdependence and shared outcomes

- Identifying Blockers and gaps

- Identifying Behaviours

- Putting in place new structures

In addition, we can help HR Directors with

- Strategic Workforce planning

- Digital Transformation

- HR Transformation

- Change management

- Recruitment Excellence – readiness assessment and implementation

- Culture

- People

- HR Target Operating Model

- HR Processes

- HR Supplier Management

- HR Rewards

- Talent Acquisition and Management

- Performance Management

- HR ITS and Applications (WorkDay, SAP HCM, Oracle HCM)

- Programme and Implementation Support

Get in touch to find out how we can help your organisation with strategy, digital and HR transformation.

CONTACT US TO FIND OUT HOW WE CAN HELP

Healthcare change: a perfect storm is brewing

Curzon Consulting Healthcare lead, Chetan Trivedi, argues that a perfect storm is approaching in Healthcare, and it’s been brewing for a while…

On one hand, we are seeing an ageing population, with growing multiple comorbidities, requiring more complex care. On the other hand, according to the International Monetary Fund (IMF), in 2017, global debt had reached an all-time high of $184 trillion in nominal terms, the equivalent of 225 percent of GDP.

In order to “move the needle”, Healthcare systems need to radically move away from “tinkering round the edges”, and instead, focus on delivering transformative change (focusing on prevention, implementing new care delivery models enabled by technology, better triaging and stratifying patients to determine best intervention point (hospital, community, home, etc.), leveraging appropriate skills set to treat patient (physician versus pharmacists versus nurse, etc.).

Some of the choices may not be popular, but if left unchecked, on the current trajectory, we will leave the future generation with a formidable challenge.

So, what are the 10 factors generating the perfect storm in healthcare?

1. Economic headwinds

Unprecedented level of total global debt-to-GDP (225%)* during peace time. Simply printing more money, creating more debt or throwing more funds at an outdated healthcare system is not going to help. Health systems need to improve quality and reduce cost-per-capita quickly. Focus on evidence-based disease prevention is key.

*Global debt has reached an all-time high of $184 trillion in nominal terms, the equivalent of 225 percent of GDP in 2017. On average, the world’s debt now exceeds $86,000 in per capita terms, which is more than 2½ times the average income per-capita. International Monetary Fund, 2019

2. Demographic time-bomb

An aging population with multiple comorbidities is requiring more complex care, so healthcare patients need to be better triaged and stratified to determine the best intervention point (hospital, community, home, etc.). The global population aged >60 years numbered 962 million in 2017, more than twice as large as it was in 1980. This figure is expected to double by 2050.**

3. Disease burden proliferation

We are seeing an increased prevalence of long-term chronic conditions such as hypertension and Type 2 diabetes. These are likely to add pressure on primary and secondary care organisations. Healthcare systems need to radically re-think “healthcare” with a greater focus on prevention and alternative care models such as community, home; GP vs. Pharmacist vs. Nurse.

4. Capacity constraints

The overcrowding of hospitals and emergency departments by patients who can been seen outside of the acute setting are causing delays for patients with higher levels of acuity to be seen earlier. Healthcare patients need to be better educated, triaged and stratified to determine the best intervention point (hospital, community, home, etc.).

5. Regulatory changes

Regulators are increasingly playing catch up with a fast paced, rapidly evolving healthcare sector, particularly with respect to innovation and technology. Commissioners are also pushing for greater cost transparency across the entire healthcare sector (i.e. hospital and drug pricing in the US, diagnostic and drug pricing in India, etc.)

6. Technology disruption

Rapid advancements in Artificial Intelligence (AI), Blockchain, Genomics, Telehealth, Remote Monitoring technologies and customised medicines are allowing clinicians to deliver precision healthcare, whilst improving patient experience and lowering cost. Innovation promises to deliver speed, quality and productivity at scale and lower cost.

7. Patient expectations

Consumer expectations are rapidly rising. Younger patients are increasingly seeking to access care on their terms. The Patient-Doctor relationship is being transformed (“The Patient Will See You Now”***). Older patients are expecting far greater quality of life until much later in life, placing a major strain on healthcare systems such as orthopaedics and physiotherapy.

***The Patient Will See You Now, authored by American cardiologist, geneticist, and digital medicine researcher, Eric Topol

8. Healthcare model transformation

There is increasing pressure to develop high quality, less-expensive alternatives to traditional hospital care models. Increasing focus on delivering care in the community and patient’s home. Move towards Integrated Care, Value Based Outcome, etc. models to drive convenience, improved quality and aligned incentives (payers vs. provider).

9. Challenging treatment protocols

Pressure from patients and clinicians to challenge existing disease treatment protocols. For example, healthcare patients with long term chronic conditions such as type 2 diabetes experimenting with low-carb diets to stop and reverse disease. Focus on prevention through life style changes.

10. Healthcare data explosion

An exponential increase in electronic data is being generated across the Healthcare continuum. AI and connected medical devices will take data generation and storage requirements to a scale not seen before. Securing all this data (on potentially a Blockchain) will be a leading priority for all stakeholders across healthcare.

Sign up to receive future healthcare insights to your inbox.

Chetan Trivedi

I lead Healthcare at Curzon Consulting.

For over 15 years I have supported Healthcare payers, providers and medical devices companies on strategy, operational improvement and digital transformation engagements across the UK, wider Europe, Middle East, US, India and Canada.

I am deeply passionate about improving health outcomes, safety and quality of life for patients.

Contact us for more information or submit a request for proposal to our healthcare consulting team

Digital transformation across UK infrastructure

Curzon Consulting have partnered with Victoria Trukhanovich to deliver an MBA research project at Cass Business School, on the topic of digital transformation.

Over a series of articles we will explore existing challenges, business requirements, relevant technologies and strategy that needs to be applied by infrastructure organisations in order to design and perform transformative digital change successfully.

In this introductory piece we present a summary of findings on the current state of digital adoption across the infrastructure industry, including the transport, utilities and construction sectors.

Using digital transformation to address challenges

The challenges that companies operating physical infrastructure face include:

-

- aging assets

- frequent incidents of underperformance

- capacity congestion

- inefficient capital and maintenance programmes,

- strong regulations

- dissatisfied customers

Digital transformation is increasingly viewed as an enabler to address these issues, providing opportunities for infrastructure companies to achieve significant gains in areas of system resilience, capacity utilisation, asset productivity, process efficiency and customer engagement.

Lagging digital maturity

Yet, the digital maturity of infrastructure companies lags behind that of many other industries. Although level of maturity varies across and within sectors, the majority of infrastructure companies have not started to implement digital technologies on a wide scale and digital activities are fragmented. Due to a number of legacy factors, infrastructure companies often lack the capacity to build a clear digital vision and drive technological change throughout the organisation.

Empirical evidence from digital transformation projects, conducted by Curzon Consulting with UK transport infrastructure network owners, water and sewerage companies and airport operators, reveals the common challenge of an inconsistent approach to digital integration. Companies often run innovative, technology-enabled initiatives on a project-by-project basis without systematically integrating technologies in line with strategic objectives.

The digital transformation strategy challenge

A dispersed digital agenda was thus found to be the most pressing challenge for companies to solve in order to assert direction within the transformation process and consolidate digital initiatives around achieving clear business objectives.

This study asks how infrastructure companies should go about developing an effective digital transformation strategy. The urgency of addressing this challenge is exacerbated for companies in competitive markets as digital leaders and emerging start-ups are well positioned to identify adjacent niches and secure dominant shares quickly.

The role of technology

To offer a summary of digital strategy recommendations, we seek to:

- assess the potential of critical digital technologies to deliver industry objectives

- identify key capabilities enabled by technological advancements

- examine the evolutionary timeline of digital transformation

- analyse organisational functions affected and value outcomes generated

Developing a framework for successful digital transformation delivery

Once developed and agreed at the corporate level a digital strategy framework can be used by infrastructure companies to evolve from an ‘adapting- enterprise systems’ approach into a smart network operator approach. Although each digital transformation programme will have a degree of uniqueness, the framework developed within this study offers a high-level plan for successful development and delivery of digital change in infrastructure sectors.

Effective transition to the state of being a digital-champion also requires a company to make important early decisions often targeted at legacy factors that would otherwise inhibit change. Those decisions include establishing a strong leadership position, engaging an appropriately skilled workforce, removing silo-based barriers, instituting cultural change in the corporate mindset and addressing ways of working throughout the organisation.

This article marks the first in our Digital Change for Infrastructure series.

This article marks the first in our Digital Change for Infrastructure series.

Sign up to receive future insights to your inbox.

Find out how Curzon Consulting can help your business

Related articles

Nothing found.

CONTACT US TO FIND OUT HOW WE CAN HELP

Patient experience: the case for home dialysis

We have just completed a major assessment of hospital, satellite and home dialysis delivery models.

Home dialysis: a cost effective solution that improves quality of life

We reviewed the efficacy and cost models associated with hospital, satellite and home dialysis models in multiple countries. In conclusion, whilst it’s not a one size fits all solution, home dialysis is a clear winner for the majority of people on dialysis.

Not only is a home dialysis solution 30-60% more cost effective over hospital and satellite models, it allows patients to perform dialysis in the comfort of their own home, significantly improving quality of life. No longer do patients have to visit a hospital or satellite centre 3 times per week/4-5 hours a session (incl. avg. commute time).

In addition, patients at home can perform nocturnal dialysis, which allows them to maintain a normal working life, which it itself results in wider benefits to the individual and society.

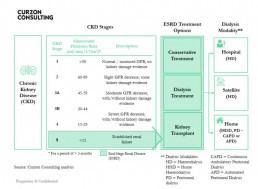

What is Chronic Kidney Disease?

- There are 5 stages of Chronic Kidney Disease (CKD). Stage 5 is classified as end stage renal disease and is when a patient requires renal replacement therapy (transplant or dialysis)

- The Glomerular Filtration Rate (GFR) measures the amount of blood that passes through the tiny filters (glomeruli) in the kidneys, each minute

- The National Service Framework for Renal Services defies normal renal function as estimated GFR = />90 ml/min/1,73M2

- As Chronic Kidney disease (CKD) progresses the GFR falls

- Patients in ESRD have three treatment options:

1) Conservative Treatment – manage symptoms of kidney failure via lifestyle changes

2) Dialysis Treatment – conduct haemodialysis or peritoneal dialysis

3) Kidney Transplant – replace kidney; more cost effective over 10 years than dialysis, but shortage of donors, means dialysis segment will grow - Patients who commence dialysis can have their treatment at a hospital, satellite (standalone clinic) or home

- Haemodialysis and Peritoneal dialysis have similar long-term survival rates

How prevalent is Chronic Kidney Disease in England?

- In England, there are an estimated 2.8m diagnosed and undiagnosed people (6.1%) of the population (>16 years old) that are thought to have CKD (Stage 3-5).

- In 2018, total population in England was ~56m, of which, >16 years old accounted for 45.4m (81%)

- CKD affects ~2.8m people over the age of 16. An estimated ~60,000 patients have End-Stage Renal Disease (ESRD), of which, ~30,000 are on dialysis

- Prevalence rates are rising, largely due to better detection (2.4% in 2007, 4.3% in 2010 and 6.1% in 2017), poor nutrition and lifestyles, which is likely to cause pressure on health budgets

- Prevalence of chronic kidney disease stage 3-5 is expected to increase to 3.2m people by 2021 and 4.2m by 2036

- There are ~40,000 premature deaths every year due to chronic kidney disease (that’s enough people to fill the Royal Albert Hall nine times over)

- Chronic kidney disease diminished quality of life for many people and represents a significant financial burden on the NHS

- Black, Asian and minority ethnic communities are five times more likely to develop chronic kidney disease than other groups

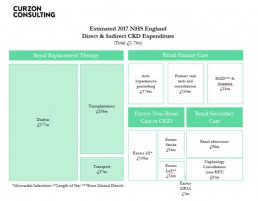

What are the costs of Chronic Kidney Disease in England?

- NHS England spends £1.7bn per annum on CKD (more than the combined £1.4bn cost to treat breast, lung, colon and skin cancer)

- Patients with CKD are likely to develop other health conditions, namely Hypertension, Stroke and/or Myocardial Infarction, resulting in adjacent costs in other non renal areas

- Mean annual direct cost of Dialysis care per patient is estimated to be £577m/30,000 = £19,233

- Full reimbursement by NHS and free at point of care

Source: Public Health England, CKD Prevalence Estimates published in 2014; Chronic Kidney Disease in England – The Human and Financial Cost; Curzon Consulting analysis

Annual dialysis cost by modality (hospital, satellite and home)

Home dialysis solution is not for all patients. Based on our analysis, when home dialysis is utilised, it can cost up to 40-60% lower than dialysis performed in hospitals and 30-40% lower when compared with satellite clinics

The total annual cost of delivering APD and CAPD is substantially lower than that for HD.

Studies in Belgium, Canada, France, Germany, Italy, Japan, Netherlands, Spain, Sweden, Switzerland, UK and USA also found home-based modalities to be more cost effective.

In some countries, two patients can be treated on CAPD versus HD.

Despite overwhelming clinical and commercial evidence, home-based dialysis remains a small segment.

Payment models drive perverse incentives and therefore influence modality selection.

Find out how we can help you to design and implement this solution

If you’d like to learn how to design and implement an evidence-based home dialysis proposition, which can significantly reduce cost and transform patient quality of life, please get in touch.

We can help you to design and implement an evidence-based home dialysis proposition, which can significantly reduce cost and transform patient quality of life.

About the author

Chetan Trivedi

I lead Healthcare at Curzon Consulting.

For over 15 years I have supported Healthcare payers, providers and medical devices companies on strategy, operational improvement and digital transformation engagements across the UK, wider Europe, Middle East, US, India and Canada.

I am deeply passionate about improving health outcomes, safety and quality of life for patients.

CONTACT US TO FIND OUT HOW WE CAN HELP

Mobile stroke units - a stroke management study

Curzon Healthcare lead Chetan Trivedi has just completed an extensive study of Mobile Stroke Units (MSUs) in Australia, Argentina, Canada, Germany, Norway and the United States of America.

Our study included a detailed review of the efficacy of stroke management solutions, including the impact on economic and social costs downstream. We have also performed a detailed assessment of people, process and technology required to implement such solutions in other countries. Whilst our example shared below is focused on the UAE, a MSU can be implemented by any health system.

By adopting a Mobile Stroke Unit model, a health system can increase stroke survival rates, reduce disabilities and optimise the associated economic and social cost of care for stroke survivors through drastically decreasing “alarm-to-scan” and “scan-to-treatment” times.

Given our extensive intellectual capital (research and analysis) on the topic, we are able to develop a high-level business case within a few weeks for a local, regional or national health system.

Opportunity to Revolutionise Stroke Management in United Arab Emirates

By adopting a Mobile Stroke Unit (MSU) model, the UAE can increase stroke survival rates, reduce disabilities and optimise the associated economic and social cost of care for stroke survivors through drastically decreasing “alarm-to-scan” and “scan-to-treatment” times.

1. Situation

- There are two key types of stroke: ischemic and haemorrhagic

- Globally, ischemic stroke is the most common, occurring 85% of the time; but whilst haemorrhagic strokes only occur 15% of the time, they are responsible for 40% of deaths

- In the UAE, stroke is the third leading cause of death – “10,000 people suffer from stroke… every year”

- Stroke is the “number one cause of disability” – with only “10% of victims reaching a hospital on time to make a full recovery”

- Stroke “is estimated to cost the UAE around AED 3 billion per year, with additional cost to the economy of a further AED 4 billon in lost productivity, disability and informal care”

- The UAE had no stroke units in 2014 versus 12 in 2019, which is a major step in the right direction

- “The average age of occurrence of stroke is 45 in UAE which is much lower than the world age of 60 years”

Stroke is a major problem for health systems

2. Complication

- 2,000,000 brain cells/ neurons are lost every minute after a stroke, which translates to “Time is Brain”

- The earlier the stroke patient is diagnosed and treated, the better the patient outcomes, leading to a significant reduction in total cost of treating the patient over the life of their associated disabilities

Typical traditional model for stroke treatment is:

- Patient transported via ambulance into Accident & Emergency (A&E) or a specialist stroke unit

- Type of stroke determined by CT scan (a stroke patient cannot be treated until the type of stroke is determined)

- Treatment is administered based on stroke type (ischemic and haemorrhagic)

Through-out the entire process (from acute symptom onset to treatment), significant time is lost, which results in higher mortality risk and additional complications downstream

Correct diagnosis and time to treatment is crucial

3. Question

Despite great progress made in stroke intervention in the UAE in recent times, what can the UAE do to deliver transformative change to increase post stroke survival rates, reduce disabilities associated with stroke, improve patient quality of life post stroke and reduce the associated economic burden on the stroke patient, their family and wider society?

4. Solution

- Instead of patients being transported to A&E or a specialist Stroke Unit, losing valuable time, a specialist Mobile Stroke Unit (MSU) can travel to the patient to deliver emergency point-of-care diagnosis and treatment onsite

- The Mobile Stroke Unit solution was pioneered in Germany back in 2011 and such solutions are being delivered in Australia, Argentina, Canada, Germany, Norway and the US

Key Mobile Stroke Unit attributes typically include:

- appropriately trained emergency response team (e.g. driver, paramedic, critical care nurse and CT technician, optional Vascular Neurologist)

- a Computerized Tomography (CT) scanner

- a point-of-care laboratory system (e.g., serum sodium, potassium, chloride, ionized calcium, total CO2, glucose, etc.)

- a telehealth solution, where a Vascular Neurologist and Pharmacist can video call into the Ambulance to provide guidance to the paramedic team

- an Artificial Intelligence solution to provide on-site diagnosis to rule out stroke-like symptoms (e.g. migraines, seizures, Bells Palsy, inner ear problems etc.), which may not be related to stroke

The most important benefit of the Mobile Stroke Unit is rapid diagnosis of the stroke type and treatment with intravenous tissue plasminogen activator (TPA) can be started more rapidly if appropriate

A randomised controlled trial shows, treatment with Intravenous TPA can be started within an average of 38 minutes when patients are treated in an Mobile Stroke Unit compared with 73 minutes under the existing model

Evidence shows on-site stroke treatment improves patient outcomes

Source:

https://www.stroke.org/understand-stroke/what-is-stroke/hemorrhagic-stroke/; The Epidemiology of Stroke in the Middle East, El-Jha et al 2016; https://www.arabhealthonline.com/magazine/en/latest-issue/2019-show-issue/mechanical-thrombectomy-for-acute-ischaemic-stroke-in-uae.html; The mobile stroke unit and management of acute stroke in rural settings, Shuaib and Terakihi 2018; https://gulfnews.com/uae/health/know-the-signs-of-a-stroke-and-where-to-get-help-1.65494094; Curzon Consulting analysis

CONTACT US TO FIND OUT HOW WE CAN HELP

How to leverage your workforce

In his latest blog post, Rodrigo Quezada explores what business leaders can do to manage a workforce comprised of five generations.

Make your workforce your secret weapon

In the workplace, times they are still a’ changing… For businesses to remain prosperous they need to face a number of challenges, including how to leverage an inter-generational work force with different needs and motivations. In fact, today’s workplace can contain up to five generations: Traditionalists, Baby Boomers, Generation X, Millennials and Generation Z.

Business models are navigating disruptive technology and changing customer needs. In addition, companies across all industries need to be able to leverage their workforce to maintain their competitive edge. So, with such a diverse workforce that covers a wide range of generations, how can leaders keep their people engaged, productive and motivated? When designing organisation transformation programmes, these are the goals that I focus on. Whether the workforce is comprised of Traditionalists, Millennials, Gen X, Gen Z or all of the above, designing specific organisational structures to keep everybody working at their optimal levels in the workforce is key.

The generations redefining the workplace

Definitions of Millennials and Gen Zs, and the distinctions between them, vary according to the source. No matter the definition, these generations have transformed how people engage with work and communicate. This is influencing the way businesses must operate, now and in the future.

Characteristics of Millennials and Gen Zs

There are always be exceptions to the rule, but there are broadly a number of characteristics that define these generations:

-

- Experience over material– One study found that 78% of millennials would choose to spend money on a desirable experience or event over buying something desirable, and 55% of millennials say they’re spending more on events and live experiences than ever before. This affects the appeal of traditional perks offered by companies to their employees.

- Responsibility – Purpose is king and wider social value is becoming an increasingly important factor

- Digital – As ‘digital natives’, communication and consumer purchases are driven by digital devices and platforms

- Flexibility – Working 9-5 is no longer the way to make a living. Flexibility is increasingly important. As featured in a The New York Times article this week, “the rest of their lives happens on their phones, not tied to a certain place or time — why should work be any different?”

Enabling "Generation Go" to Stay

Millennials have been nicknamed “Generation Go”. To utilize their energy and commitment in the workforce, businesses need to provide flexibility and keep pace with them, or risk losing out on the very competitive edge that comes along with the innovation they bring. Traditionalists, Baby Boomers and Gen X leaders need to find a way to share their business knowledge with millennials. Currently, millennials are managing 65% of the work of others globally. If you haven’t focused on the retention of this generation, you could lose leverage. Studies have shown that millennials are more likely to change jobs due to the economy over previous generations.

The top reasons Millennials and Gen Z choose to leave a job is:

- Lack of shared purpose and connection to a bigger goal

- Minimum wage growth

- Lack of advancement opportunity

- Excessive hours

- A work environment that doesn’t foster teamwork

What business leaders can do

As a business leader, it’s important to understand the mentality of your workforce. This is increasingly complex due to the multiple generations. Some basic cultural elements will never change such as having decent morals and respect for your fellow employees, but truly understanding how different generations tick could be the driving force for a successful business. By the year 2025, it is predicted that 75% of the workforce will be comprised of Millennials and Gen Zs. Therefore business leaders must understand how to attract millennials, retain them, and maximize their job performance.

Importantly, business leaders must also know how to effectively create succession plans while maintaining a strong focus on execution and innovation, incorporating new generations like Millennials. Sharing skills between generations is key – adopting new ways of communicating while also passing down the critical business knowledge that has been accumulated throughout the organisation. For a successful workforce, leadership must excel in understanding their employees and how to leverage different types of knowledge to excel and lead in the market.

Communication is a two-way street

In my experience I have found that the most effective way for senior leadership teams to engage in this two-way channel is to create special spaces like buffer zones which include forums, channels, and programmes that consistently maintain an open communication kept alive and relevant on both ends. This, combined with the more classic approaches like Leadership Development Programmes, and High Potential programmes give enough “credentials” for a programme to be taken seriously and succeed over time.

Key questions business leaders can ask about their culture

If companies want to become generational friendly and attract an elite and talented workforce to keep the company progressive and lucrative, it may be time to make some changes.

- Does your company have a clear and shared purpose? Statistics now show employees perform better when they feel a connection to peers and management towards something bigger than just profits and business results

- Is your company culture rigid or flexible? Foster a community-type atmosphere. Get rid of the top-down management structure and replace it with a more lateral management approach with tons of open communication.

- Does your company still require formal business wear every day? Change to a more casual dress code, dress down.

- Are your incentive and compensation schemes effective? Start offering perks that go beyond cash bonuses that studies show are so easily forgotten. Instead, offer company vacations as incentives.

Enabling each employee to share their skills with the wider team, regardless of generation, is key. With the tremendous amount of knowledge and experience older generations have, offering apprentice and mentorship programmes are a great way to make the top and bottom of organisations closer and close the gap that may exist between different approaches. It is one of the best ways for business leaders to engage new generations and identify new business opportunities for the long term growth and path of an organisation.

Learn to leverage your workforce, and make it your secret weapon.

About the author

Rodrigo Quezada

Rodrigo is a strategy and operations Managing Consultant designing and leading business transformation projects

CONTACT US TO FIND OUT HOW WE CAN HELP

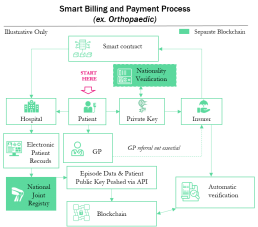

Blockchain in healthcare: a use case

Curzon Healthcare lead Chetan Trivedi explores how Blockchain in healthcare will revolutionise the billing and payment process. This will result in the complete disintermediation of a vast administrative layer within the healthcare Provider and Payer (private insurer or public commissioner) organisation.

Consequently, Healthcare Providers and Payers will see a huge benefit through a more streamlined process of handling claims and processing payments. The process will also include various steps like checking patient insurance eligibility and coding claims.

Illustrative smart billing and payment process

The example shown below is based on an insured patient, but the process would be similar for the public sector.

1. Upfront

- Insurer and Provider enter into a Smart Contract on Ethereum blockchain

- The smart contract would be self-executing with the terms of the agreement directly written into code

- The smart contract would exist on a distributed and decentralised blockchain network

- Smart contract would permit trusted transactions and agreements to be carried out between Insurer and Provider without the need for manual intervention (Provider and Insurer), central authority, legal system, or external enforcement mechanism

- Each transaction would be completely traceable, transparent, and irreversible

- Automated invoice and subsequent payment would be triggered (i.e. self-billing) inline with pre-agreed protocols and care pathway (incorporated into the Smart Contract)

- Micropayments are triggered after each care package has been completed

- Penalties are built into the Smart Contract and are assessed automatically if Provider fails to meet quality metrics (e.g. readmission rates, infection rates, revision rates, etc.) or poor outcomes (e.g. PROM, Oxford scores)

2. Ongoing

- Patient experiences symptoms (e.g. increase pain, reduce mobility etc.)

- Patient visits GP (Physician) or contacts Insurer directly (based on policy guidelines)

- Patient accesses Insurer policy automatically using Private Key

- Insurer automatically routes referral to Orthopaedic Consultant or Provider inline with policy

- Patient commences journey through care pathway (e.g. pre-op, op, post-op, discharge, follow up, etc.) and is treated by the Provider against a pre-agreed set of protocols (consultation, imaging, pathology, implant, physiotherapy, etc.) with the Insurer

- Provider feeds data into Electronic Patient Records (EPR). Standard data linked to specific non identifiable Patient Public Key and is published automatically onto the Blockchain via API

- Insurer automatically validates treatment against pre-agreed care pathway and protocols and automatically triggers payment (see Payment Triggers to left)

About the author

Chetan Trivedi

I lead Healthcare at Curzon Consulting.

For over 15 years I have supported Healthcare payers, providers and medical devices companies on strategy, operational improvement and digital transformation engagements across the UK, wider Europe, Middle East, US, India and Canada.

I am deeply passionate about improving health outcomes, safety and quality of life for patients.

CONTACT US TO FIND OUT HOW WE CAN HELP

Hospital at home: key considerations

Hospital-at-Home: an Important Component of an Integrated Care Model

New technology is arming and enabling care providers with the ability to provide seamless support to patients along the entire care continuum. Hospital-at-home care delivery models allow health systems to find the right access and intervention point for delivering targeted patient solutions

The case for change

- Unprecedented levels of total global debt to economic output (debt-to-gdp ratio) during peace time. Simply printing more money, creating more debt or throwing more money at an outdated healthcare system isn’t going to help*

- Aging population with multiple comorbidities are requiring more complex care, so patients needs to be better triaged and stratified to determine best intervention point (hospital, community, home, etc.)

- Increase in prevalence of long term chronic conditions such as hypertension, type 2 diabetes, etc. are better suited to alternative care models (e.g. community, home, etc.)

- Overcrowding of hospitals and emergency departments by patients who can been seen outside of the acute setting are causing delays for patients with higher levels of acuity to be seen earlier

- Rapid advancements in telehealth and patient remote monitoring technologies are allowing clinicians to observe and examine patients remotely, and at scale, allowing care providers to do more with less

- Consumer expectations are rapidly increasing as they demand better care experiences and improvement in quality of life

- Pressure from payers to develop high quality, less-expensive alternatives to hospital care

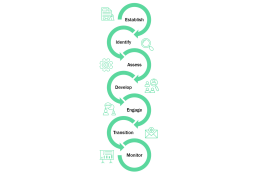

7 key considerations for a Hospital-at-Home Model

- Establish clear objectives of why your organisation is seeking to set up a hospital-at-home model. For example, is it to drive early discharge, optimise admission avoidance, diversify income stream, etc.

- Identify conditions e.g. congestive heart failure, chronic obstructive pulmonary disease, community acquired pneumonia, etc. suitable for home care delivery models based on clinical evidence. Establish patient qualification criteria for hospital-at-home programme.

- Assess patient suitability (against qualification criteria), including functional risk assessment for hospital-at-home care model. Assess patient home for safety / hazards, heating, etc.

- Develop a personalised care plan upon first care provider visit. Personalised patient care plan can be developed by a doctor, pharmacist or nurse (the latter two under the supervision of a doctor using a telehealth solution if needed).

- Engage with patients and caregivers (family members or friends). Ensure anyone supporting the patient at home is part of development of the care plan. Where appropriate, self management (with clinical support) of treatment /condition must be discussed and agreed with patient.

- Prepare patient transition from hospital-at-home programme to primary care setting. Send discharge summaries to the patient’s primary care doctor via electronic patient records system, email, etc. The transition is absolutely key and must be handled flawlessly to avoid patient “falling through cracks”.

- Monitor and provide 24/7 coverage should patient require readmission. Provide in-home diagnostic tests, medications, and equipment (if necessary). Engage with care providers in wider community as needed (e.g. palliative care services, mental health).

*Global debt has reached an all-time high of $184 trillion in nominal terms, the equivalent of 225 percent of GDP in 2017. On average, the world’s debt now exceeds $86,000 in per capita terms, which is more than 2½ times the average income per-capita. Source: International Monetary Fund (IMF), Jan ‘19

About the author

Chetan Trivedi

I lead Healthcare at Curzon Consulting.

For over 15 years I have supported Healthcare payers, providers and medical devices companies on strategy, operational improvement and digital transformation engagements across the UK, wider Europe, Middle East, US, India and Canada.

I am deeply passionate about improving health outcomes, safety and quality of life for patients.

CONTACT US TO FIND OUT HOW WE CAN HELP

Driving performance in public sector infrastructure

Nigel Brannan highlights the importance of mastering the basics for a performance focused infrastructure organisation.

The performance challenge

Public sector organisations have long recognised the need to be more outcome and performance focused. While signalling the right intent, many struggle to translate desired outcomes into tangible outputs from their employees and suppliers.

A general ethos of reducing cost above all else compounds this challenge. Furthermore, the organisations often outsource the problem to a supply chain that is increasingly fragmented and under pressure to bid for contracts at very low margins. Suppliers then hope to make money from variations to the original contract that either were not or could not be specified up front, often taking advantage of their client’s poor planning, organisation or decision making.

The supply chain

Partnerships and collaborations are often touted as mechanisms for delivery assurance and improved performance but there are still significant inconsistencies in their effectiveness and practicality. The biggest challenge is usually to align organisations around incentives, which often involves increasing risk in exchange for higher profit, and ensuring that all parties are focused and organised around a common outcome. This is easier said than done.

For major, complex infrastructure projects, it extends beyond the physical construction effort to incorporate the planning and design phases. The public and political outcry at the spiralling cost of many high-profile programmes, or fear that they will overspend significantly, comes from a perceived inability to nail critical decisions, and plan and design in a reasonable timeframe. There are many political reasons why the champions of HS2, Hinckley Point C and Heathrow’s third runway continue to say those projects will deliver for the quoted costs, but the odds are that they will not.

The role of innovation

Innovation and digitisation play important roles in improving the performance of infrastructure organisations. Much of our work involves implementing innovation and digital strategies, but we do it through the lens of following the money. That means mastering the basics of productivity and performance, which starts with knowing what your core success measures are and how you are performing. In infrastructure delivery, you need right to left planning. This means working backwards from the answer on what needs to be in place and by when to hit key milestones and performance outcomes.

The move towards a performance management culture

Curzon & Company is currently partnering with a major public sector infrastructure client to move the organisation towards a performance management culture.

There are three stages in addressing the performance challenge –

Scan, Focus and Act:

- Scan establishes the baseline, trajectory and key drivers of performance. One critical output is a single version of the truth across scope, activity, cost and risk

- Focus is about prioritisation and channelling effort to where it has most impact. Major wins often come from an emphasis on looking forwards and addressing future risks rather than reporting historical performance.

- Act means actually doing things differently. It involves engaging the organisation and their partners at programme and project level to adopt new ways of working. Common measures, good information and ‘heartbeat’ disciplines get results.

None of this is rocket science, but it is remarkable how many organisations struggle to put it into practice.

The benefits

Our client now has transparency of previously hidden efficiencies, providing them and their regulator with the confidence that they are meeting their commitments. They can manage the affordability of the programme proactively – a key benefit where scope requirements evolve over time.

They are offsetting build cost risks by focusing on high-cost elements with standardised product design and productivity benchmarks. Most importantly, they are deploying tools and disciplines at project site level where success (or failure) is delivered.

The successful partnership between the client team and Curzon continues, helping to strengthen the foundations as the client migrates towards a new operating model.

This article originally featured in Raconteur, March 2019

About the author

Nigel Brannan

I lead Infrastructure at Curzon Consulting

I've over 30 years of consulting experience leading major transformation programmes and strategy assignments with major utilities, transport and civil engineering organisations.

CONTACT US TO FIND OUT HOW WE CAN HELP

Digital innovation empowers water companies

In an article published in The Times Raconteur, Edem Eno-Amooquaye discusses how digital innovation is empowering water companies to be more proactive, strategic and efficient in how they deal with property developments.

This article is based on a project with Anglian Water that has had a dramatic impact on customer service and efficiency in Developer Services.

Water companies are looking to harness emerging automation technology and smart data to transform their services. Often this requires a new way of working, closely focused on defined business outcomes, effective digital innovation and proper collaboration.

Among them is Anglian Water, which has established close working relationships with a small group of expert companies to digitally transform its developer services business. This transformation will deliver process efficiencies and more than £20 million of savings over the next five years.

Ian Amis, Head of Developer Services at Anglian Water explains:

“Historically, our customers would come to us and say ‘we have a development and we need water infrastructure’ and then we would come up with a solution. With our project we will have visibility much earlier, when engaging with property developers is still just a thought for landowners wanting to sell, enabling us to be more proactive, strategic and efficient”

The systems fully digitise the application process, planning and asset delivery. They also provide advanced geospatial capabilities that include drawing polygons for developer services applications – the first such programme in a UK water utility – and offer automated workflow management. In contrast, many other utilities only digitise or outsource application submission and assessment, and some have no digital capability at all in their developer services businesses.

The success of the project in meeting measured strategic outcomes means its application has been carefully broadened. “We began with a focus on low-volume, high-complexity schemes, but realised these platforms will work for all our one-off customers, our builders and our big developers as well,” says Mr Amis. He describes the work as “totally transformational” because the water company is able to provide developers with much better experiences and is ready to meet the customer service requirements of Ofwat’s new AMP7 DMeX measure.

“Grosight and Inflow are equipping Anglian Water with the capability to take a strategic approach to asset planning across the entirety of a water resource zone and recycling catchment area, reducing design costs by identifying site clusters and efficient solutions,”

explains Curzon managing consultant Edem Eno-Amooquaye.

Better site visibility provides greater insight on the needs of property developers, enabling sustainability initiatives such as water reuse to be encouraged and cutting the cost of late changes.

During the project, collaboration between business functions, IT and delivery teams has been essential. As guardian of the business case, Curzon Consulting has orchestrated this collaboration and taken responsibility for grounding all technical requirements and design functionality in the reality of business benefits.

“Curzon Consulting has led in defining the change management strategy to ensure the benefits of digitisation and new ways of working are embedded within the developer services business”

explains Edem.

This critical role has served to provide assurance to both Anglian Water and the IT team throughout the life cycle of the programme.

To make the relationship work between separate companies, in such a crucial commercial context for Anglian Water, all the parties have focused on growing together. The process has proved to be highly efficient and open, with the customer at its heart.

Our work with Anglian Water on digital innovation has won several awards such as Innovation Consultant of the Year and Most Innovative Cloud Product of the Year.

This article originally featured in Raconteur, September 2018

About the author