Leveraging effective negotiation to deliver up to 50% more value for a major international airport

The issue

- Frontline ‘negotiators’ not trained – Teams lacked clarity on effective, strategic negotiations

- Power balance leaning to suppliers – Although the airport had leverage, suppliers secured favourable contract terms

- Costs above benchmark – Costs were identifed as 20% to 40% above benchmark for critical success

Solution

- Benchmarking & Research

- Gained clarity on the as-is situation. Conducted supplier forum

- Build Strategy

- Tenders, direct negotiations, demand management

- Deliver Negotitations

- Reduced costs, and aligned supplier contracts with strategic goals

- Train Stakeholders

- Equipped them with best practices to ensure long-term value in contracts

- Operating Model Change

- Ensured cost savings are locked in the organisation for the long term

- Build Future Roadmap

- So the organisation can use the training and model to deliver further savings

The results

- Training and Development of Client Team

- Empowered the client team with strategic procurement and negotiation skills, resulting in more balanced contracts and enhanced decision-making capabilities

- Client – Supplier Power Dynamic Changed

- Rebalanced power dynamics, shifting leverage back to the client and achieving more favourable contract terms

- Cost Reductions Delivered

- Achieved over $7 million (AUD) in savings and improved negotiation outcomes by up to 50%

Find out how we can solve the key challenges facing your organisation

5-year strategic plan to uplift recurring revenue by 80% through organic growth within four years

The issue

- Our clients was experiencing significant changes in the largest customer segment

- Leading to a material decline in client revenues

- EBITDA fell below business case targets

Solution

- Sized the UK medical consumables market for 10 segment, including private acute, NHS, care homes

- Created a vision for the organisation in collaboration with the client senior leadership team

- Shortlisted target segments to drive organic growth

- Developed win strategies and business model options for each segment

- Identified approaches to extend treatment and care pathways into a patient’s home

- Developed a 5-year financial plan including revenue projections and investments required

The results

- Identified multiple growth pathways to reach 80% revenue growth within four years

- Developed a balanced framework of win strategies to drive incremental revenue and EBITDA growth

- Generated a 5-year strategic plan, go-to-market launch and implementation roadmap to capture the identified incremental income

Find out how we can solve the key challenges facing your organisation

Driving market focused resource allocation decisions

The issue

- A business unit of a global speciality chemicals producer supplying catalysts for industrial applications to multiple markets across all geographies

- Capacity constrained and being challenged to improve overall business profitability

- Shared manufacturing assets serving multiple market-facing business units

- Upcoming regulatory changes required product recipe changes with implications on the existing production process

- Limited attempts to address supply constraints in an effective manner, with over-stated demand and poor sales & operations planning disciplines

Solution

- Establish & exploit true production capacity of existing assets:

- Identification and elimination of bottlenecks in supply chain & productions

- Drive for OEE in existing plant (batch size & sequencing, down time & maintenance etc.)

- Identify options to reallocate capacity use to more profitable customers

- Identification of customers & volumes yielding below average contribution allowing for either renegotiation or re-allocation

- Establish cross-market segment view of long-term demand

- Markets & functions created fact base & presented in facilitated cross functional sessions to build cross markets view & build priorities for overall business

- Revamped S&OP including product profitability of prospect pipeline to ensure capacity is utilised for highest financial returns

The results

- CAPEX spend avoidance of £18m with extrapolated implications to the whole division of c. £100m

- Improved joint-management understanding on the levers of capacity & profitability, supported by a cross-market decision making governance process to make data based trade-offs

- Increased production capacity through de-bottlenecking (e.g. batch sequence & maintenance optimisation) with potential resulting contribution uplift of ~ £ 10m p.a.

- 235 tonnes of unlocked capacity through selective elimination of low margin product variants and Sales re-alignment

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Delivering greater procurement efficiencies for a construction company

The issue

- £1billion division split into 6 semi-autonomous business units, spending £450m per annum on materials and sub-contracted services

- Each business unit under revenue and margin pressure especially those dependant on public sector work

- By re-establishing good procurement practices a modest 3% savings target was agreed upon, the stretch being that the full cash saving had to be delivered in-year

- No single picture of procurement spend or performance compared to the external market

- Procurement & supply chain savings were already baked into business unit budgets and there was pressure from plc to deliver over and above this

Solution

- Created a definitive ‘spend cube’ and with it a single set of numbers

- Completed a top-down and bottom-up analysis of spend at the detailed category/supplier level and agreed impactable spend

- Created and executed a prioritised implementation plan closely monitoring and recording the benefits as they are realised

- Redesigned the P&SC organisation bringing in the necessary skills and expertise as required

The results

- In-year cash savings of £8million with an exit run rate of £10million per annum

- New operating model fully installed and driving benefits (sustainability)

- Benefits fully traceable within business unit P&L

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Operational excellence at a key site for a marine engineering products division of a global organisation

The issue

- An engineering, fabrication & assembly facility supplying deck machinery equipment to the marine industry, was severely underinvested in, with old facilities & equipment and remote from Group HQ

- Seen as a failing site with internal customers losing trust in its ability to deliver

- Disconnected planning and production functions causing late delivery and high costs

- No effective performance management system in place to drive improvements

- Very high inventories due to a lack of control of demand and production priorities

- Intention to transfer products in from Scandinavia and establish a low-cost supply centre of excellence

Solution

- Evaluation of the primary issues and development of a site transformation plan

- Focused on OTIF as the critical performance metric; established cross-functional planning with short interval control to manage demand and delivery to promise

- Improved data integrity, reset planning parameters and re-established ERP system use

- Re-organised operations to improve flow through the factory and to establish schedule adherence

- Implemented practical lean operational disciplines centred around PDCA

- Addressed excess inventory, control of stock, kitting and warehousing operations

- Established effective performance management across all functions

- Coached management to develop capability and establish sustainable improvement

The results

- Delivery performance improvement OTIF from 14% to 95% within six months

- 45% reduction of inventories within one year

- Jump in recovered factory revenues from effective demand management & increased delivery to commitments

- Engaged and productive workforce with a clear understanding of what was required of them

- Successful capital upgrade completed while continuing to supply

- Site was established as a Centre of Excellence for deck machinery and achieved Group award for excellence

- Asked to repeat a similar exercise at another site in the Far East

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Delivering business turnaround

The issue

- The UK business of a global construction materials manufacturer had been losing money for several years due to inefficient operations and declining sales in an industry sector experiencing extremely challenging times.

- A full business review and improvement plan were required to stabilise the business and address the financial performance.

- Significant cost reduction efforts had already been made to offset the declining sales and lower margins, but the business was continuing to lose money.

- Sales lacked the basic tools and capabilities to compete effectively and operations were poorly managed resulting in over-production, an inefficient organisation and poor working practices.

- The leadership team was highly dysfunctional and lacked the capability to define and execute a plan to address the situation.

Solution

- Undertook a full situational analysis of the business operations and identified changes required to reverse the performance trend

- A comprehensive change programme was designed and implemented with the full involvement of the business management team

- Recognising that the current actions were primarily to address the initial objective of eliminating the business losses, a parallel stream of work focused on the market and development of the future strategy for the business

- This dovetailed with the reorganisation of the commercial functions and outlined the business’s future journey to go beyond a break-even situation and achieve acceptable returns

The results

- The programme had a significant impact on the business across all areas of the value chain and delivered a sustainable bottom-line improvement of over £5m p.a in 12 months.

- In addition to the delivered cost optimisation actions the re-focusing and capability development work with the sales team secured a contract renewal with three principal customers and the acquisition of a new major account and stemmed the loss of any further business.

- The new ways of working that focus on using sound management information to run the business and to action issues have taken root across the organisation. Decision making improved and continuous improvement is becoming established.

- The Group Executive sees the step change in performance that was achieved in the timeframe as the most successful intervention of its kind across the portfolio in recent years.

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Applying lean principles to a deliver a step change in performance in a construction environment

The issue

- Over a year behind plan due to technical difficulties and the inability to establish an effective delivery model

- Significant efforts were made to find a workable engineering solution but continuing to fail in meeting planned delivery cycle times

- Accruing significant non-recoverable costs on extending leases of expensive marine engineering plant

- Accepted reality that most delays were either due to weather or one-off events and therefore non-addressable

- Reliant on experienced agents, managers and foremen to manage communication without the need for much structure or formality

- The aim was to achieve a repeatable 14-day ‘production’ cycle, from a starting point of 19 days as the demonstrated best achievement

Solution

Working with the project team to identify and implement:

- An optimal production process with defined task times against which the project could plan, execute and measure performance

- Introduction of cross-functional short-range planning discipline to improve visibility and reduce the instances of unplanned stoppages through poor communication and lack of coordination

- Strengthening the cascade communications to the front-line teams to ensure the right plan was being executed

- Prioritisation of the process improvement pipeline to accelerate the implementation of the highest impact solutions

- Establishing adherence to a standard process and course-correcting back to the agreed sequence if unplanned events caused the deviation

- Previously each cycle had effectively been ‘bespoke’

- Using close monitoring to highlight avoidable downtime and to identify operational fixes, e.g deck layout standardisation

The results

-

Cycle time was compressed to less than the on-target 14-day sequence on a sustained basis, and as low as 10 days, with associated cost savings of ~£0.5m per cycle.

Having the Curzon team ‘embedded’ within the project proved effective in understanding the complexities and challenges of the operating environment. Pragmatic and tailored interventions and a ‘test and learn’ approach encouraged adoption and ownership.

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Business performance turnaround for a multi-country division of a global building products group

The issue

- LATAM division of a €3bn global construction product manufacturing & distribution group

- Country-based business units in 14 geographies from Mexico to Chile with 3,500 staff generating revenues of €400m

- A sustained period of under-performance with operating margins at sub-3% making it the worst-performing division in the Group

- Divisional layer not adding any value with local businesses being left to operate independently, some with more success than others

- An extended analytical diagnostic by a global consulting firm had established the scale of the problem, but no credible and accepted plan to address the issues had emerged

- The need was for pragmatic help to make change happen with the full buy-in of local management

Solution

Plan and mobilise stage

- Confirm the scale of the improvement opportunity

- Agree targets and align with budgets to have one set of numbers

- Create a plan and a governance model to balance top-down coordination with full engagement from the business units

Delivery stage

- Initial focus on four of the largest markets where impact potential was greatest

- Reduction in margin leakage through pricing optimisation, product mix & discount control

- Introduction of operational excellence basics across manufacturing facilities

- Inventory optimisation, including clean-up of obsolete and slow-movers

- Reduction of corporate overhead layer and leverage of shared service centre to reduce in-country costs

- Capability development of management and teams across all disciplines

The results

- The Division was transformed from worst to best performer in the Group within 12 months

- Operating margin tripled and accrued benefits delivered were 45% above the programme target

- Working capital was reduced by €25m

- The change management effort involved over 1,000 staff across all functions and businesses

- Awarded ‘Best International Project’ by the UK Management Consultancies Association

- Curzon entered a risk-reward commercial arrangement on benefits delivered

We wanted a step change in performance, done in a way that would build capability to make it sustainable… the results speak for themselves. – Divisional CEO

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Lean value chain analysis and design for global precision engineering products leader in aerospace industry

The issue

- A complex multi-stage casting, machining and coating operation manufacturing precision components for the aerospace industry

- Underperforming organisation and low levels of ownership for improvement

- Extremely low velocity through the process, with poor yields and excessive scrap

- High inventories of work in progress and finished goods

- Production measures encouraging over-production

- Silo mentality in operations exacerbating the WIP situation

- Disaffected workforce with little interest in driving continuous improvement and no effective performance management in place

Solution

- Analyse the current situation to articulate the operational improvement potential (yield uplift and inventory reduction)

- Create the business case for change (P&L and cash impact)

- Design a pilot to create an integrated supply chain for the largest volume product including suppliers and JV partners

- Detail design of a pull model and elimination of WIP stages along the entire supply chain

- Re-design of the layout and organisation to separate ‘dirty’ and ‘clean’ operations to reduce rework

- Launch of a continuous improvement approach within the shop floor to tackle scrap, rework and productivity issues

- Design and introduction of a cascaded performance management framework

The results

- 40% reduction in inventory identified through WIP elimination

- The feasibility of a 50% reduction in production lead time confirmed

- 10 percentage-point improvement in yield performance from closer process control

- Plan to deliver £5m savings in-year agreed

- Changes to ways of working implemented in pilot cells with Lean work-flow approach trialled

- Programme of Lean training and continuous improvement projects implemented

- New KPIs are being used to drive the performance of the value chain in place of traditional cost absorption metrics

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Re-assessing cost after COVID-19

The global COVID-19 pandemic has provoked the need for businesses to re-assess their footprint and cost base across the supply chain. John Mason, Manufacturing & Engineering Services Partner at Curzon Consulting, considers the case for structural change.

Re-assessing cost after COVID-19

The COVID-19 crisis has altered the landscape for many. Some have already acted to reduce staff numbers and consolidate operations as an initial response to falling revenues. Structural change and a lower cost base may be required to adapt for the longer term driven by:

- Altered demand volumes, market location and mix of products and services as markets and the customer base evolves

- New regimes to protect health and wellbeing that change how people can work

- The increasing de-globalisation trend, prompting a re-think on the resilience of supply chains and moves to localise

The scenarios and options for each business will be different and the ‘best fit’ answer will not necessarily be obvious.

Considering the case for structural change

Supply-side capacity

- What capacity is needed now and for the medium term? Can excess capacity be re-purposed to meet expected new demand or is consolidation possible?

- Restructuring the footprint is an opportunity to deliver a step change in the cost base and renewed focal points for future investments

Network view

- How fit for purpose are existing facilities now? Can a more cost-effective and resilient model be found by looking at the network as a whole?

- Potential changes to both demand and supply-side environments will impact the economics of the current model and an holistic view is needed

Supply chain

- Will customers demand more localised sourcing to reduce interruption risk in their business-critical supply chains? Is a pre-emptive move to adapt the footprint more attractive than a reactive one?

- Sourcing and certifying new suppliers may be a critical dependency for re-locating production. It is also an opportunity to re-think make-buy strategies, secure new capabilities, strengthen key supplier relationships and unlock cost savings

Overhead right size

- What opportunities from changed working practices should now be evolved to deliver a lower overhead cost model?

- Remote working, greater comfort with and reliance on technology, and demonstrated operation with reduced indirect staffing levels creates new baselines for the operating model

Digital evolution

- What opportunities are created through a reshaping of the footprint to accelerate adoption of digital technologies?

- Relocation of capabilities to be better aligned with future demand will require assessment of products, processes, assets, resources and technology infrastructure. Introduction of technology to deliver cost and service advantage may be achieved in a more concentrated way, more quickly and with greater impact as part of a footprint reshape than through retrofit in a sub-optimal model

Affordability

- How will transition be funded and what prioritisation is required? A balanced-risk business case and plan are needed

- Parallel effort to drive out non-value-add activity, reduce working capital and target efficiencies in the current model will create additional headroom to manoeuvre

Having dealt with the immediate threat from COVID-19, executives, stakeholders and shareholders are now turning their attention to what comes next.

Businesses that are proactively considering the options now will be better placed to make the right moves to sustain and grow.

How we can help

We have broad experience of working with industrial clients to deliver higher levels of profitability and resilience by optimising the cost base, with managed risk and without compromising business value-add service delivery.

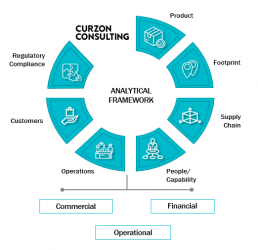

Our bespoke Assessment Model is a tried and tested approach balancing commercial, financial and operational considerations. We can rapidly examine the possibilities, frame the options and quantify the associated benefits and risks to underpin confident decision-making.

We bring a business-led focus, an insight-driven approach and a pragmatic attitude to help our clients make informed decisions. And where needed we assist in delivering the business case.

Contact us to explore how to deliver a more resilient and cost optimised business in a post-COVID environment.