Curzon Sponsors the 2024 AMBS Case Interview Competition

Curzon Consulting is thrilled to sponsor this year’s Alliance Manchester Business School Consultancy Case Competition.

Introduced in 2016, the competition enables AMBS MBA students to showcase their skills, innovative thinking, and problem-solving abilities. It’s a platform that challenges them and provides them with real-world experience in tackling complex business scenarios in preparation for interview processes across a variety of industries.

Curzon is a key recruitment partner for the full-time MBA programme, and everyone involved is excited to further develop this relationship. Last Friday, Curzon representatives Nigel Brannan, and AMBS Alumni Sarbo Saha, and Aziz Yuldashev, joined the group and were introduced to the students, leading them through an interactive case study session.

We also heard from Class 2025 students Yasar W Khan and Syed Arhaam Ahmed from last year’s winning team, who both shared their top tips on how to succeed in the competition.

The students now have a few months of preparation before the preliminary rounds begin in January 2025. We can’t wait to see how everyone gets on!

Nigel said

We deeply appreciate Chris Garnett and Nick Burrows for your support and are excited by the enthusiasm and energy of the participating MBA students. It’s a pleasure to partner with you on this valuable and enjoyable aspect of their course”.

Thank you to Nigel Brannan, Sarbo Saha and Aziz Yuldashev for your assistance on the day.

CONTACT US TO FIND OUT HOW WE CAN HELP

Highly Commended in the 2024 MCA Awards

10 Years of Continued Success

Huge congratulations to the Curzon Consulting team – marking 10 years of continued success at last night’s MCA Awards. Amidst strong competition, we proudly secured a Highly Commended award in the Commercial Impact category.

This outstanding achievement is a testament to the incredible work of the joint Marston Holdings and Curzon Consulting team, who delivered exceptional results within an impressively short timeframe.

The judges said this was a “project which used an imaginative approach and truly showed the power of a consulting team in delivering commercial benefits.”

Commercial Impact with Marston Holdings Ltd

Marston Holdings Ltd (MHL), a private equity-backed enterprise with a turnover exceeding £350 million. Primarily operating within the UK, the company caters to diverse sectors, prioritising services related to legal and regulatory obligations enforcement, including but not limited to parking enforcement, fine collection, and management.

MHL embarked on a transformative journey to achieve remarkable growth, with a focus on unlocking substantial savings through a strategic procurement programme. In collaboration with Curzon Consulting, MHL aimed to address challenges such as insufficient spend visibility, dominant incumbent suppliers, and limited procurement influence within the organisation.

Under the leadership of Curzon Consulting and CEO Martin Johnson, the project, named Project Eagle, aimed to drive sales, optimise costs, and enhance productivity. The procurement transformation programme set out to revamp MHL’s procurement organisation while delivering substantial savings.

Curzon’s approach was multi-faceted, leveraging deep data analytics, innovative thinking, and tried-and-tested change management methodologies. The process involved three main workstreams: Spend Opportunity Assessment, Benefits Delivery, and Procurement Organisation Assessment.

The Spend Opportunity Assessment phase involved a rapid analysis of MHL’s spend, identifying significant savings. Despite initial challenges, the team delivered the core assessment in less than five business days. Subsequent phases focused on implementing cost-saving initiatives, including achieving quick wins within the first two months.

The Benefits Delivery phase saw the implementation of various procurement strategies across different expenditure categories, such as strategic sourcing, product harmonisation, and make vs. buy analysis. These initiatives led to significant cost reductions.

Additionally, the Procurement Organisation Assessment aimed to enhance MHL’s procurement capabilities. Recommendations included restructuring the team, enhancing governance, and improving strategy and systems.

Throughout the project, Curzon fostered a collaborative relationship with MHL, employing a unified ‘one team’ approach and acting as trusted advisors. A well-defined governance model ensured efficient communication and problem-solving.

Despite challenges such as supplier resistance and stakeholder reluctance to change, Curzon overcame obstacles through pragmatic approaches, evidence-based reasoning, and stakeholder management expertise. The project delivered measurable results, exceeding savings targets by 28%, with a sizeable in-year cash impact. Qualitative outcomes included improved transparency in spend areas, satisfaction with new products, and enhanced trust in the procurement team.

In conclusion, the partnership between MHL and Curzon Consulting exemplified resilience, innovation, and successful collaboration, resulting in significant cost savings and organisational improvements.

Chetan, Stephane and the Curzon team were contracted to deliver an optimisation programme at Marston Holdings. The Curzon team approached the complex task with energy and professionalism, which was key to the ultimate success of the programme.

The technical knowledge and capability of the Curzon team were clear from the start of the engagement and we had total faith in their capability to deliver the ambitious goals they had been set. Marston would recommend Curzon to anyone who requires the domain knowledge and experience of a capable consulting partner. We look forward to working with them in the future

Martin Johnson, CEO, Marston Holdings Ltd

CONTACT US TO FIND OUT HOW WE CAN HELP

Navigating the future: AI's impact on wealth management firms

In recent months, the financial services industry has witnessed significant advancements in artificial intelligence (AI), sparking both excitement and apprehension amongst wealth managers. While the potential benefits of AI are undeniable, the wealth management sector has been understandably cautious in embracing this transformative technology. This hesitation can be attributed to several factors, including a prioritisation of addressing critical gaps in services, concerns about client relationships, and the unique needs of different market segments.

In this blog, we explore the hopes and fears of integrating AI in wealth management, balancing the potential savings and efficiencies that can come from technological advancement alongside the concerns over an erosion of personalised client services.

Back office transformation

The potential for improved efficiency through AI and machine learning is substantial, particularly in areas like automating trade settlements, automating regulatory compliance, and risk management.

However, within the technology function of many wealth management firms, the primary focus often relates to implementing new traditional services and upgrades to address key operational gaps. Implementing non-AI solutions to enhance services such as regulatory compliance, Environmental, Social, and Governance (ESG), Customer Relationship Management (CRM), and digital services are typically considered more important and lower risk.

Because of the potentially significant benefits and the remarkable pace of change in AI, we believe that wealth management firms should put aside time and budget in 2024 to carefully evaluate the potential efficiencies and cost savings offered by AI, balancing these against the benefits of their current project portfolio. This assessment will help determine if prioritising AI integration is a strategic move that aligns with their operational goals.

Front office dilemma

We are starting to see the emergence of more AI-powered tools that can transform the front office experience for wealth managers and their clients. Early adoption of these innovations has the potential to allow client advisors and relationship managers to better serve “mass affluent” clients. Use of AI in this environment could combine the advantages of a human-led personalised service and advisor judgement with the scalability and insights that AI can provide.

However, implementation of AI in the front office remains a challenge. Securing funding to develop new AI capabilities requires proof of value to the organisation and clients. Wealth managers must also weigh up the benefits against factors such as data and integration challenges, evolving financial services regulations for AI, and the perceived lack of trust from clients in insights generated from AI.

Industry evolution

We believe a small number of early adopting wealth managers armed with AI capabilities are likely to start disrupting the industry at some point in the next year. Developing a strategy, plan, and business case for AI integration is important to avoid being left too far behind.

Key considerations

- Early adoption dilemma: The decision to be an early mover or a follower with respect to AI in the wealth management market needs careful consideration of the associated risks and rewards.

- Barriers to progress: For those who decide to invest in AI, there are some foundational elements that could act as barriers to AI progress if not addressed:

- Data governance and quality: Building a foundation of sound data governance and ensuring data quality is imperative for effective AI implementation. This discipline is important in any organisation but vital to get the best out of AI solutions.

- Robust data infrastructure: Modern platforms with adaptability to change swiftly are most suitable to form the backbone of successful AI integration.

- Skilled resources: The availability of appropriately skilled individuals is critical for navigating the complexities of enterprise AI.

Conclusion

As the wealth management sector contemplates the role of AI, a delicate balance must be struck between embracing innovation and preserving the personal touch that defines many client relationships. While challenges exist, we believe that the potential rewards in terms of cost savings, productivity gains, and enhanced client experiences will make the journey towards AI integration worthwhile. Wealth managers should consider their strategy for when and how to look at the opportunities that AI can provide for them to ensure that they don’t fall behind their competitors.

CONTACT US TO FIND OUT HOW WE CAN HELP

Can charging supply keep pace with electric vehicle demand?

Net-zero carbon emissions by 2050…

Electric vehicles (EVs) are increasingly heralded by nations across the globe as a vital part of the net-zero transition to reduce emissions, and the key technology for decarbonising transportation, which accounts for 13% of emissions globally. But whilst vehicle sales have been booming in recent years, the installation of charging networks that underpin EV usage are trailing dangerously behind. The extent of this lag is particularly concerning in the United Kingdom (UK) where it poses a fundamental threat not just to the continued growth of the EV market, which by the end of 2023 is projected to be worth £16bn, but it threatens any plans for the UK to reach net zero carbon emissions by 2050.

A global EV boom driven by three central influences

Such has been the drive to increase the uptake of EVs, that global sales of Battery EVs (BEVs) and Plug-In Hybrid EVs (PHEV) doubled in 2021 from the previous year, and 2022 saw a +55% increase in global EV sales over ‘21. The registration of 10.5 million new vehicles in ’22 was despite component supply chain shortages and disruptions from the war in Ukraine that hampered output. With approximately 27 million EVs on the road today, they now account for a global market share of 13% of vehicles on the road.

What is clear is that as global consumers increasingly align their climate-driven values with vehicle purchasing, the number of EVs on the road will continue to rise exponentially. This is an ‘EV boom’ that has been accelerated by a combination of three central influences:

- Sustained governmental policy support, in the form of subsidies and incentives, pledges to phase out internal combustion engines (ICEs), and lofty electrification targets

- The rise in the availability and performance of EV models, which now gives consumers five times as many to choose from than in 2015

- Electrification of fleets by car manufacturers, in a race to meet rising consumer demand.

Showcasing the innovations and ideas behind EV market growth

The annual London EV show and conference, held at the end of November ‘22, is a platform where stakeholders from all three market influences gather to showcase the innovations and ideas that are spearheading the UK EV transition. With representation from the entire value chain, this year’s event included collaborations between government representatives, fleet management, charging systems & solutions providers, battery technology providers, major car manufacturers, and other influential stakeholders.

Attending the show provided me with a ‘peak-under-the-bonnet’ of the UK EV market and shed light on some of the key trends emerging in 2023 and beyond. Conference talks included those from industry leaders and leading research centres, amongst the latest vehicle innovations being showcased. These talks had one key common theme – that whilst a marketplace as dynamic as EVs offers great opportunity, commercially and in tackling climate change, capitalising effectively on these opportunities over the next few years will be fraught with challenge for the UK.

UK charging infrastructure is struggling to keep pace with the EV growth

The London EV show highlighted just how much the UK EV market has expanded in recent years in line with global growth, notching up an impressive 92% increase in EV registrations between January ‘21 and January ‘22.

UK charging, however, is still in its infancy relative to the vehicles it powers, and comparatively lags behind. There is a growing disparity between the growth rates of EV sales in the UK and charge point installations. This divergence threatens to impede the UK from meeting climate-goals set by the government and derail the feasibility of the UK’s ban on internal combustion engines (ICEs) that looms in 2030.

When you compare the absolute number of public charge point installations the UK needs to support the proposed transition, with current figures, it is clear there is still a long way to go. If the government’s 2022 charging infrastructure strategy successfully meets its ambition, by 2030 there should be over 300,000 public chargers installed nationwide. In comparison, as of January ‘23, there were cumulatively just 38,000 public charge points available across the UK.

More importantly, though, is considering the pace of charger installations relative to new EV registrations – which is slowing owing to the continued acceleration of new EV registrations. Since January ‘20, the cumulative number of EVs in the UK has increased 3.8X, whereas the number of charge points has increased just 2.6X. This increasing disparity is made ever clearer by the change in the UK’s EV-to-charge point ratio – a measure which helps assess the suitability of a nation’s charging network to support its vehicle’s needs.

As a benchmark, the Alternative Fuel Infrastructure Directive (AFID), an EU policy which regulates the deployment of public chargers, recommends a ratio of 10 EVs per public charge point for EU member states.

In 2016, the UK had a healthy ratio of approximately 8 EVs per charge point. Comparatively, the UK now has the 9th worst global ratio of 21 EVs per public charge point. There are evidently key lessons to be learned from the likes of South Korea, the global leader which boasts a ratio of just 2.6.

Unlocking mass adoption with public charging infrastructure

The vehicle-to-charger gap poses a fundamental problem to the mass adoption of EVs in the UK, for two main reasons. Firstly, on average, 30% of UK households lack off-street parking for residential charging. This figure rises to around 40% across major UK cities, and as high as 50% in London. These households will therefore have to rely on the public charging network – either off-street slow, charging, or nearby fast/rapid charging hubs – to charge their vehicles at home.

This scenario works, provided there are enough charge points to accommodate users. However, too few chargers pose a major barrier for drivers switching over from ICEs, who will view EVs as impractical until there is somewhere suitably convenient to charge them.

When Which? surveyed 1.5k electric car owners, nearly half said that their nearest public chargers were over a 20-minute walk away.

Not exactly convenient.

The logic is the same looking across the UK’s charging network for longer journeys. For true mass adoption, there needs to be enough charge points to make charging your vehicle battery as convenient as filling up with fuel currently.

Speak to any EV owner in the UK, however, and they will tell you of the growing issues around public charging: long queues, a myriad of payment systems and apps to contend with for different charge-point-operators, and chargers which simply don’t work (experienced by 4 in 10 customers of public EV chargers).

This is not conducive to convincing the masses to switch from ICE vehicles to the more sustainable option of electric.

These issues with the charging infrastructure will continue to exacerbate as drivers become increasingly reliant on public chargers, versus at home or work, the more that make the switch to EVs. The UK urgently needs to accelerate its plans for large-scale installations across the public charging network, which is so far failing to deliver the c.100 installations per day needed until 2030 – last month (Jan ’23) just 28 charging devices were installed per day. A large-scale programme such as this requires a unified drive from all stakeholders.

As demand and supply continue to fall out of balance, this situation presents opportunities for private investment in the expansion of the charging networks. The current EV charge point operator market is highly fragmented and lacks a ‘gold-standard’ of consumer vehicle charging. There is a clear market need that so far appears unfulfilled in both availability and quality.

Whilst there are a multitude of other challenges that must be addressed, such as ensuring a sufficient supply of electricity to meet charging demands, each of these challenges offers their own commercial opportunities.

For those considering entering or expanding within the space, now is the time to answer the key strategic questions – what is the ‘Size of the Prize’ available? Which of the current barriers-to-adoption offer the greatest opportunities if addressed effectively, and how can that value be harnessed?

Milo Eadie

Milo is a strategist and transformation consultant with experience across capital projects, electric vehicle fleets and charging infrastructure, and product development. He began his career as a design engineer in the nuclear industry, where he consulted on the UK's fleet of reactors.

His expertise includes business strategy, data-driven decision making, productivity optimisation, and applied innovation and implementation. He is passionate about combining these skills to support clients in achieving their Net-Zero ambitions.

Milo is a Master of Engineering (MEng, Hons) from the UK’s leading General Engineering course at the University of Bristol, where he gained specialisms in Sustainability, Project Management and Entrepreneurship.

CONTACT US TO FIND OUT HOW WE CAN HELP

Recessions are easy to forecast, so how can CEOs better prepare to weather the economic storm?

‘A rising tide lifts all boats’ is an aphorism associated with the idea that good CEOs can drive business growth during the good times. However, in my experience…

exceptional CEOs drive remarkable growth during economic downturns!

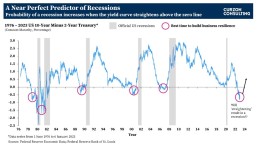

No matter what anyone tells you, recessions are easy to forecast. It’s the severity of the recession that is difficult to predict. One of the most watched charts in economics is the 10-year US treasury interest rates minus the 2-year US treasury interest rates (a.k.a. Yield Curve chart), which has a near-perfect record of forecasting recessions. The yield chart is currently flashing a ‘code red’ highlighting a recession is highly likely within the next 12-18 months. However, it is not all doom and gloom!

Smart CEOs can leverage the yield curve date to ensure their businesses are fortified to weather the upcoming economic storm. As shown on the chart, building financial and operational resistance should be a key priority of executives whilst the yield curve remains inverted!

What is yield curve inversion, and why does it matter?

To simplify… the chart shows the 10-year US treasury interest rates minus the 2-year US treasury interest rates. In a normally functioning economy, the longer the bond maturity, the higher the interest rate (yield) demanded by investors. Investors seek higher returns on longer maturing binds as risks become more difficult to anticipate the longer the term extends into the future.

However, when investors are worried about the economy, they get concerned with the ‘here and now’. Therefore, investors demand higher interest rates on short-term maturities; hence, an inversion between the 10-year and the 2-year interest rates takes place.

An inversion occurs when the 10-year US treasury interest rate minus the 2-year US treasury interest rate falls below zero.

Pre-1990s, recessions were recorded whilst the yield curves were inverted (i.e. below the zero line). Post-1990s, all recessions were recorded after the yield curves straightened (post the initial inversion).

As of 6th January 2023, the yield inverted at -0.69. This inversion is flashing a major warning signal! If history repeats again, there is likely to be a recession once the yield curve straightens again.

The question is… how deep will the recession be? That’s hard to forecast, but the current inversion rate is much deeper than what we’ve post-1990. If the inversion continues to deepen similar to the early 1980s, we could potentially see a large recession following.

So what?

As highlighted on the chart, the best time to start a business transformation programme and build financial and operational resilience is when the yield curve is inverted and well BEFORE it straightens again (i.e. rises above the zero line).

CEOs and CFOs should utilise the yield curve chart to kick start or accelerate an existing business transformation programme, well before a recession arrives.

If you are interested in learning more, please get in touch