Reimaging Radiology Equipment Maintenance Models - How to Enhance Cash Flow and Drive Inflation Busting Savings

With inflation at a 40-year high, how can large, multi-site operators of diagnostic equipment achieve transformative savings whilst maintaining quality?

According to Mordor Intelligence, the UK diagnostic imaging equipment market is estimated to be USD 1.1 billion in 2022 and is expected to reach USD 1.5 billion by the end of 2027.

Our research highlights, the typical profit margin on new diagnostic equipment such as a PET (Positron Emission Tomography), MRI (Magnetic Resonance Imaging), CT (Computed Tomography), Fluoroscopy, Ultrasound, X-Ray, etc... is 10-15%. However, the profit margin on maintenance contracts is > 35%.

The typical annual maintenance cost of an MRI scanner is £50,000-£70,000 and CT Scanner is £30,000-£50,000. The sum cost of all the individual maintenance contracts can mount up very quickly to several million pounds!

The actual cost of a maintenance contract can vary depending on volume discounts, hours of operation, uptime guarantees, and scope of what is included or excluded inclusions – coils, helium, etc…, along with other cost drivers.

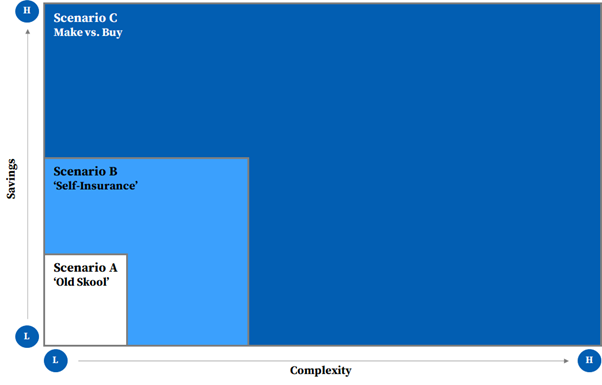

We believe there are 3 key operating models with each one driving a progressive level of savings. Scenarios B and C deliver transformative, inflation busting savings, but are the most complex to implement.

Savings vs. Complexity

Over the past few years, some organisations have turned to third-party maintenance service providers as an alternative to traditional Original Equipment Manufacturer (OEM) warranty and post-warranty support. This move has yielded substantial savings. However, that is just one solution amongst a range of others.

Scenario A – ‘Old Skool’

Under Scenario A, an organisation negotiates a full-service, gold-standard, maintenance contract with an OEM or third-party maintenance service provider.

‘Old Skool’ model can generate 10-15% savings.

Scenario A works well for a single or small hospital / diagnostic service provider business. For a large private hospital group or a diagnostic imaging service provider, this model is ‘old skool’, and worst of all, the buyer transfers significant value to the seller.

For organisations that operate a larger portfolio of diagnostic equipment, where there is a critical mass, our extensive and deep understanding of the market shows two alternative models. Both models require an open mind and can be explored together to ‘turbo-charge’ saving.

Scenario B – ‘Self-Insurance”

Under Scenario B, an organisation leverages a ‘self-insure’ model where it adoptings a risk management technique in which the company accrues a ‘pool of money’ to be used to remedy an unexpected loss from equipment breakdowns. Organisations can self-insure against equipment breakdown, and mitigate risk of large unforeseen losses by taking out implementing an excess insurance policy.

Under this scenario, an organisation buys a preventative maintenance (PM) only contract from an OEMs (Original Equipment Manufacturers) or third-party maintenance service providers, with a pre-negotiated price list for parts. The organisation pays for breakdowns as and when needed from accrued funds.

If risk is –managed appropriately, organisations can significantly enhance cash flow and savings.

‘Self-insurance’ model can generate 15-25% savings.

Scenario C – ‘Make vs. Buy’

Under Scenario C, an organisation makes a ‘make-or-buy’ decision where it chooses between setting up an in–house maintenance organisation (people, process, and systems) versus purchasing the service in part or whole from an OEM or third-party maintenance service provider.

‘Make versus buy’ model can generate 25-40% savings.

Under both Scenarios, an organisation can decide to carve-out some or all types of the diagnostic equipment for self-insurance, based on a risk assessment of service levels and uptime guarantees required per site or department.

The additional savings can be used to reinvest in new equipment, upgrades and/or drive digital transformation programmes to enhance productivity of the radiology department and improve administration, technician, clinician and patient experience.

Failure to get this right can have a material, knock-on impact on operations, patient and clinician experience, and a material loss of revenue whilst a machine is out of use.

How Can Wwe Help?

We have developed a deep understanding of the diagnostic imaging equipment market. We help clients to challenge the status quo and drive transformative benefits via the successful implementation of Scenario B and/or Scenario C.

For Scenario B – ‘Self-Insurance’, we have a methodology and proprietary analytics tools that allow us:

- accelerate the evaluation of a ‘Self-Insurance’ model

- assess financial treatment of accruals

- design options based on risk tolerance of the business

- develop a business case

- develop management information dashboard to monitor and track solution

- implement solution

For Scenario C – ‘Make vs. Buy’, we have a methodology, proprietary analytics tools and experience designing in-house operating models, that allow us:

- accelerate the evaluation of a ‘Make vs. Buy’ model

- perform maintenance demand analysis by geography

- design new Target Operation Model (TOM) options for the ‘Make’ solution

- develop a business case

- develop implementation and risk mitigation plan

- embed new TOM within an organisation

If you are interested in learning more, please contact me at chetan.trivedi@curzonconsulting.com.