Reimaging Radiology Equipment Maintenance Models - How to Enhance Cash Flow and Drive Inflation Busting Savings

With inflation at a 40-year high, how can large, multi-site operators of diagnostic equipment achieve transformative savings whilst maintaining quality?

According to Mordor Intelligence, the UK diagnostic imaging equipment market is estimated to be USD 1.1 billion in 2022 and is expected to reach USD 1.5 billion by the end of 2027.

Our research highlights, the typical profit margin on new diagnostic equipment such as a PET (Positron Emission Tomography), MRI (Magnetic Resonance Imaging), CT (Computed Tomography), Fluoroscopy, Ultrasound, X-Ray, etc... is 10-15%. However, the profit margin on maintenance contracts is > 35%.

The typical annual maintenance cost of an MRI scanner is £50,000-£70,000 and CT Scanner is £30,000-£50,000. The sum cost of all the individual maintenance contracts can mount up very quickly to several million pounds!

The actual cost of a maintenance contract can vary depending on volume discounts, hours of operation, uptime guarantees, and scope of what is included or excluded inclusions – coils, helium, etc…, along with other cost drivers.

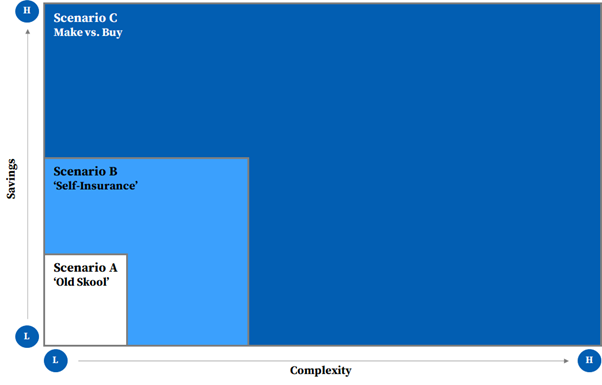

We believe there are 3 key operating models with each one driving a progressive level of savings. Scenarios B and C deliver transformative, inflation busting savings, but are the most complex to implement.

Savings vs. Complexity

Over the past few years, some organisations have turned to third-party maintenance service providers as an alternative to traditional Original Equipment Manufacturer (OEM) warranty and post-warranty support. This move has yielded substantial savings. However, that is just one solution amongst a range of others.

Scenario A – ‘Old Skool’

Under Scenario A, an organisation negotiates a full-service, gold-standard, maintenance contract with an OEM or third-party maintenance service provider.

‘Old Skool’ model can generate 10-15% savings.

Scenario A works well for a single or small hospital / diagnostic service provider business. For a large private hospital group or a diagnostic imaging service provider, this model is ‘old skool’, and worst of all, the buyer transfers significant value to the seller.

For organisations that operate a larger portfolio of diagnostic equipment, where there is a critical mass, our extensive and deep understanding of the market shows two alternative models. Both models require an open mind and can be explored together to ‘turbo-charge’ saving.

Scenario B – ‘Self-Insurance”

Under Scenario B, an organisation leverages a ‘self-insure’ model where it adoptings a risk management technique in which the company accrues a ‘pool of money’ to be used to remedy an unexpected loss from equipment breakdowns. Organisations can self-insure against equipment breakdown, and mitigate risk of large unforeseen losses by taking out implementing an excess insurance policy.

Under this scenario, an organisation buys a preventative maintenance (PM) only contract from an OEMs (Original Equipment Manufacturers) or third-party maintenance service providers, with a pre-negotiated price list for parts. The organisation pays for breakdowns as and when needed from accrued funds.

If risk is –managed appropriately, organisations can significantly enhance cash flow and savings.

‘Self-insurance’ model can generate 15-25% savings.

Scenario C – ‘Make vs. Buy’

Under Scenario C, an organisation makes a ‘make-or-buy’ decision where it chooses between setting up an in–house maintenance organisation (people, process, and systems) versus purchasing the service in part or whole from an OEM or third-party maintenance service provider.

‘Make versus buy’ model can generate 25-40% savings.

Under both Scenarios, an organisation can decide to carve-out some or all types of the diagnostic equipment for self-insurance, based on a risk assessment of service levels and uptime guarantees required per site or department.

The additional savings can be used to reinvest in new equipment, upgrades and/or drive digital transformation programmes to enhance productivity of the radiology department and improve administration, technician, clinician and patient experience.

Failure to get this right can have a material, knock-on impact on operations, patient and clinician experience, and a material loss of revenue whilst a machine is out of use.

How Can Wwe Help?

We have developed a deep understanding of the diagnostic imaging equipment market. We help clients to challenge the status quo and drive transformative benefits via the successful implementation of Scenario B and/or Scenario C.

For Scenario B – ‘Self-Insurance’, we have a methodology and proprietary analytics tools that allow us:

- accelerate the evaluation of a ‘Self-Insurance’ model

- assess financial treatment of accruals

- design options based on risk tolerance of the business

- develop a business case

- develop management information dashboard to monitor and track solution

- implement solution

For Scenario C – ‘Make vs. Buy’, we have a methodology, proprietary analytics tools and experience designing in-house operating models, that allow us:

- accelerate the evaluation of a ‘Make vs. Buy’ model

- perform maintenance demand analysis by geography

- design new Target Operation Model (TOM) options for the ‘Make’ solution

- develop a business case

- develop implementation and risk mitigation plan

- embed new TOM within an organisation

If you are interested in learning more, please contact me at chetan.trivedi@curzonconsulting.com.

CONTACT US TO FIND OUT HOW WE CAN HELP

Natalia Sokolova

Partner, Public Sector

+44 (0)1653 628596

Natalia is passionate about the digital world and committed to supporting the Public Sector in undergoing a profound change to embrace the opportunities that technology and data can bring whilst maintaining the ongoing commitments to deliver improved citizen outcomes at a lower cost.

She holds over 17 years’ experience within the management consulting industry, in both private and public sectors. Her expertise lies in both advisory and delivery in Target Operating Models, Smart Transformation, Change Adoption, and Sustainability.

“Digital disruption is redefining the entire Public Sector. I am interested in leveraging technology, new capabilities, and insights to create valuable clients’ solutions and to develop future talent.”

CONTACT US TO FIND OUT HOW WE CAN HELP

We are delighted to welcome a new Partner for Financial Services Sector!

Curzon Consulting has appointed Andy Stewart as Partner – Financial Services, starting in October.

Andy will help drive the strategy in the financial services market, which is core to Curzon’s growth plans for the future. Working with Douglas Badham, Partner & Financial Services Sector Lead, Andy will be responsible for developing new and innovative propositions and go-to-market approaches as well as managing some of Curzon’s long-term client relationships.

Andrew Morgan, Managing Partner, Curzon said: “It’s fantastic that Andy has joined the team. He brings a wealth of background and experience that will help us add even more value to our financial services clients”

Douglas Badham, Partner & Financial Services Sector Lead, Curzon said: “I look forward to working with Andy as his expertise and strong client relationships will be invaluable to us as we execute our growth strategy”

Andy Stewart, Partner – Financial Services, Curzon said: “I’m excited to be joining the team at Curzon as they have long been committed to outstanding client service and the delivery of tangible results for their clients. I’m looking forward to getting started”

CONTACT US TO FIND OUT HOW WE CAN HELP

Award-Winning Procurement Transformation Programme

We are extremely proud to have won two awards in two months at two different ceremonies, this is true testament to the value delivered by the joint project team.

Background & Challenge

After a challenging year where the Covid-19 pandemic impacted activities and financials, our client launched an ambitious strategic initiative focused on becoming more efficient, concentrating on growth and delivering sustainable value for consumers and doctors.

The pandemic exposed an over-reliance on a ‘single’ income source. All elective activity (e.g. joint replacements, cataracts), the primary income source, was halted overnight, but a high fixed cost base remained. As a response, Curzon Consulting was engaged to design and deliver a Procurement Transformation Programme.

Our Client

Ramsay Health Care UK is one of the leading independent healthcare providers in England.

Ramsay Health Care UK provide a wide and comprehensive range of specialised clinical services from routine to complex surgery, day case procedures, diagnostic services and physiotherapy

Ramsay Health Care is well-respected in the healthcare industry for operating quality private hospitals and for its excellent record in hospital management and patient care

- 40 hospitals and facilities located across England

- Over 200,000 patients receive treatment each year in Ramsay Heath Care

- Over 7,600 staff employed at Ramsay Health Care UK

- Over 3,000 Consultants work in partnership with Ramsay Health Care

Overall Approach

Over nine months, we took a pragmatic, agile and “together” approach to accelerate benefit delivery, particularly in high spend / high complex clinical spend categories

- Conducted a full review and defined a new procurement organisation aimed at maximising value to the business

- Conducted a review of the external spending and identified cost savings opportunities within complex medical categories

- Implemented a full strategic programme that delivered multi-million £ cost savings to the business

Our Solution

1 FULL PROCUREMENT ORGANISATION REVIEW

We assessed the existing procurement organisation against eight dimensions and highlighted several data-driven insights

- Quantitatively and qualitatively assessed the procurement team, conducted time analysis, salary benchmark & reviewed performance

- Business partnering and perceived value: Interviewed key business stakeholders across all divisions

- Assessed procurement influence across all spending areas

- Defined and costed new (to-be) procurement organisation

Our Results

- A complete procurement maturity assessment highlighting strengths and weaknesses of the current procurement organisation

- A new procurement organisation was designed, profiled and costed.

- A procurement organisation designed to maximise value to the business and stakeholders

2 FULL EXTERNAL EXPENDITURE OPPORTUNITY ASSESSMENT

We conducted a full opportunity assessment on Ramsay’s external expenditure to define adequate sourcing strategies and identify cost savings opportunities

-

- Cleansed, categorised and analysed spend data; Providing full spend transparency.

- Conducted category deep dive for each key medical category, assessed current category management and supplier management

- Defined adequate sourcing strategy, identified opportunities and sourcing levers

- Identified and quantified savings potential via internal and external benchmarking

Our Results

- Category strategy for all key medical categories

- Multi-million cost saving opportunities identified

- Prioritised sourcing plan with saving targets by spend categories

- High level 3-year business plan

3 THE IMPLEMENTATION

We implemented procurement transformation and a cost reduction program

- Our methodology was specifically adapted to address demand-side cost optimisation levers. Whilst we addressed a range of spend categories and redesigned the PO, we delivered sizeable benefits in difficult clinical areas such as Orthopaedics.

- A key benefit in orthopaedics came from ensuring the surgeon selected the appropriate implant system (metal or ceramic) to match the patient’s profile (e.g. age, gender).

- Our analysis showed surgeons implanted costly ceramic hip systems in a high percentage of older NHS patients. With fixed NHS reimbursement every incremental switch impacted the bottom line.

- Our insights directly influenced the Orthopaedic Steering Group’s new policy which required surgeons to utilise lower-cost metal hip systems in older NHS patients.

- Fundamentally, a key part of the relationship was to ensure recommendations on cost improvements would not compromise clinical outcomes and patient satisfaction.

Our Results

- Delivered £multi-millions in incremental savings and a new procurement organisation

- Engaged with all key medical stakeholders and instilled a cost-consciousness culture

- Ramsay Health Care UK will benefit from the savings over multiple years

“Curzon helped us obtain the confidence and operational ‘can-do’ to drive incremental savings sooner than we could have expected, and then to push on to best practice performance.

Their skill was in balancing pace of change and the results imperative with the need to take the organisation with them on the journey.

A key achievement was building the necessary collaboration between the many functions that needed to act together to drive benefits in complex clinical spend categories.

Curzon’s strong analytical expertise, and ability help us to take a critical view on the “art of the possible” and bring the team along on the journey to demonstrate benefits delivery was a critical success factor.

The result was a tangible and ongoing commercial win, and a new Procurement Organisation to drive cost leadership, profitability and sustainability going forward”

Peter Allen

Chief Financial Officer

Ramsay Health Care UK

Contact our Procurement service line lead,Stephane Boroncelli, to find out more

Sarbo Saha

Managing Consultant

+44 (0)1653 628596

Sarbo has 15 years of work experience across a variety of fields, including nearly a decade in capital markets and payments. He began his career in energy risk management consulting, before moving to capital markets product control within two of the world’s leading investment banks. Over time, he evolved into a trusted internal risk systems optimisation expert. He has also worked at a tech startup as an offshore engineer, managed his own projects as a consultant, and built out streamlined data and risk solutions for clients across the financial services industry.

Sarbo’s expertise is primarily in financial services, data analytics, and software development. With a BSc in Mathematics & Economics, an MA in Mathematical Finance, and an MBA, he brings a hands-on, pragmatic, data-driven approach to business situations of all sizes and across industries. He particularly enjoys understanding the design and strategy of a business, seeing how its processes align with that basic design, and designing improvements and efficiencies.

He is also keenly interested in the latest developments in disruptive, innovative payment processes. During Sarbo’s MBA, he led a consulting engagement for one of the world’s largest payments companies to understand the market size and growth potential for consumer payments using stablecoins. He is the lead author of the public version of the resulting paper and report, which is the first in the world that comprehensively defines the possibilities for consumer use-cases of stablecoins.

CONTACT US TO FIND OUT HOW WE CAN HELP

Sustainable Construction Innovation, Does it matter?

The transport construction industry has significant opportunities to reduce carbon by developing materials with lower embedded carbon. Producing cement uses a great deal of energy, so finding a waste product that can substitute for cement makes good environmental sense, while concrete is always at the top of construction sites carbon emissions. Pulverised Fuel Ash, PFA, is a by-product of coal-burning power stations. The ‘ash’ is recovered from the gases and used, amongst other functions, as a cement substitute. This will reduce CO2 by reducing cement through the increased use of cement replacement and increased use of recycled aggregate.

This positive change is one of the most common ways that businesses innovate, and one used to innovate frequently. Cement product innovations play a significant role in the transition towards carbon net-zero emissions across construction industries.

The network of universities, cCatapults, and grant funding allows businesses to embrace innovation and provide more high-value services that change the industry’s innovation capability. There is unprecedented investment and attention by Government, customers and business to advance innovation capability to deliver new business outcomes that will redefine collaborative relationships across the supply chain, increase repeat business with customers and demonstrate that the industry is not a commodity and cannot be procured solely on price. What is delivered is complex and requires highly skilled people to look at delivering the best solution.

Please contact andrew.wilson@curzonconsulting.com or take a look at Curzon Consulting’s sustainability website

References:

GreenSpec. Building Design.

About the author

Andrew Wilson

Andrew is a seasoned strategy and transformation consultant with experience across Africa and the UK.

His background is in capital projects, energy, mining and sustainability. He has a passion for the crossover between productivity, growth and sustainability, complemented by his qualification from Cambridge University in Business and Climate Change: Towards Net Zero Emissions.

Andrew has built mines, towns, roads and power plants, and he aims to keep building using a sustainability lens.

Which risks are the most challenging to carbon net-zero in Africa?

There is a ‘ ticking timebomb’ in third-world countries where there is heavy reliance on fossil fuels (coal burning) for electricity and is responsible for between thirty to/forty per cent of employment. In the particular case of Africa, tThe continent is embarking on a massive expansion of fossil fuel electricity. More than 200 new power stations are planned, the majority of which will burn coal (Pollutionwatch, The Guardian). However, Africa is uniquely positioned to leapfrog dependence on fossil fuels and utilise abundant renewable resources such as solar and wind. Government legislation to reduce this dependency would see joblessness leading to hunger, civil unrest and a potential change of government at the ballot box. Trade Unions are very strong in these sectors due to human rights abuses for tens of years. For change to happen, there is a tricky hierarchy of political players to be satisfied and included before any legislation would be agreed and implemented.

What business opportunities could be related to the African net-zero transition?

Many of the countries mentioned above have very high temperatures, which provide strong sunlight. This raises solar panel opportunities. The countries are also vast and tempting medium-term investment options for wind turbines as their manufacturing costs drop and returns increase as populations grow and require electrification. Fossil fuel companies need to start investing in renewable energies to continue making positive revenue margins and balancing their emissions to carbon net-zero.

Social or economic network effects?

There are extreme views against fossil fuel companies, often with headquarters in European countries. Social media highlights these emission concerns and provides a platform to disseminate important emission information and gather people to attend anti-emissions rallies.

Contact me at www.curzonconsulting.com to discuss further.

About the author

Andrew Wilson

Andrew is a seasoned strategy and transformation consultant with experience across Africa and the UK.

His background is in capital projects, energy, mining and sustainability. He has a passion for the crossover between productivity, growth and sustainability, complemented by his qualification from Cambridge University in Business and Climate Change: Towards Net Zero Emissions.

Andrew has built mines, towns, roads and power plants, and he aims to keep building using a sustainability lens.

Why renewable energy is fuelling investor interest?

Renewables will represent 80% of the total share of investments in power generating capacity from today to 2050. Global energy needs are expected to grow by 30% between today and 2040.

As an asset class, renewable energy has matured dramatically over the past two decades. It has gone from being seen as an alternative culture to having huge investment potential. At the same time, traditional investment norms are changing and not just because of the evolving sustainability mega-trend. In recent years, investment managers have increased their allocations to the broader real assets sector with growing numbers classifying infrastructure and real estate as “real assets”.

Solar power does not pollute the air with greenhouse gases and is noise-free to be used for residential purposes. Solar opportunities are available at various scales, i.e. for households and large business ventures providing power to the grid. Solar panels are the fastest-growing renewable energy option, thanks to falling costs and increasing investment. Their easy installation and “low emissions” are environmentally friendly.

Wind turbine power will be an increasingly compelling longer-term investment due to increasing urbanisation and population growth, leading to higher electricity demand. Technological progress with relative cost advantages for renewable energies and an improved regulatory environment (social and political support) motivates businesses to manufacture wind turbines.

About the author

Andrew Wilson

Andrew is a seasoned strategy and transformation consultant with experience across Africa and the UK.

His background is in capital projects, energy, mining and sustainability. He has a passion for the crossover between productivity, growth and sustainability, complemented by his qualification from Cambridge University in Business and Climate Change: Towards Net Zero Emissions.

Andrew has built mines, towns, roads and power plants, and he aims to keep building using a sustainability lens.