UK’s Leading Management Consultants 2025

We are delighted to have been recognised in the 8th annual edition of the Financial Times UK’s Leading Management Consultants 2025 Special Report

Recommended across 12 categories an increase year on year, the annual rating, compiled with data company Statista is based on endorsements by clients and peers. It demonstrates our consistent year-on-year sector and service line growth.

Consulting companies are awarded Bronze (recommended), Silver (frequently recommended) or Gold (very frequently recommended).

Sectoral Expertise

· Chemicals & Pharmaceuticals – Bronze

· Construction & Infrastructure – Silver

· Energy, Utilities & Environment – Silver

· Financial Institutions & Services – Bronze

· Healthcare & Life Sciences – Silver

· Insurance – Bronze

· Public & Social Sector – Bronze

· Travel, Transportation & Logistics – Bronze

Consulting Services

· Digital Transformation – Bronze

· Operations & Supply Chain – Silver

· Strategy – Silver

· Sustainability – Silver

Managing Partner Andrew Morgan said

The FT Awards are a testament to our company’s continued growth, driven by our team’s exceptional talent and dedication. I’m truly grateful for their relentless commitment, passion, and ability to consistently deliver outstanding results for our clients.

CONTACT US TO FIND OUT HOW WE CAN HELP

Congratulations to Our 2024 MCA Awards finalists

Curzon Consulting Earns Recognition as Finalist in Two Management Consulting Awards Categories

We’re thrilled to announce that Curzon Consulting has been shortlisted as a finalist in two categories for the 2024 Management Consulting Awards! This prestigious recognition reflects our team’s exceptional work and positions Curzon among the industry’s elite.

Organised by the Management Consultancies Association (MCA), the #MCAAwards celebrate the transformative contributions consulting firms have made throughout the past year.

Remarkably, 2024 marks Curzon Consulting’s ninth consecutive year as a finalist, solidifying our reputation for consistent excellence.

Congratulations to all of the other finalists.

Commercial Excellence with Marston Holdings Ltd

Read More

Marston Holdings Ltd (MHL), a private equity-backed enterprise with a turnover exceeding £350 million. Primarily operating within the UK, the company caters to diverse sectors, prioritising services related to legal and regulatory obligations enforcement, including but not limited to parking enforcement, fine collection, and management.

MHL embarked on a transformative journey to achieve remarkable growth, with a focus on unlocking substantial savings through a strategic procurement programme. In collaboration with Curzon Consulting, MHL aimed to address challenges such as insufficient spend visibility, dominant incumbent suppliers, and limited procurement influence within the organisation.

Under the leadership of Curzon Consulting and CEO Martin Johnson, the project, named Project Eagle, aimed to drive sales, optimise costs, and enhance productivity. The procurement transformation programme set out to revamp MHL’s procurement organisation while delivering substantial savings.

Curzon’s approach was multi-faceted, leveraging deep data analytics, innovative thinking, and tried-and-tested change management methodologies. The process involved three main workstreams: Spend Opportunity Assessment, Benefits Delivery, and Procurement Organisation Assessment.

The Spend Opportunity Assessment phase involved a rapid analysis of MHL’s spend, identifying significant savings. Despite initial challenges, the team delivered the core assessment in less than five business days. Subsequent phases focused on implementing cost-saving initiatives, including achieving quick wins within the first two months.

The Benefits Delivery phase saw the implementation of various procurement strategies across different expenditure categories, such as strategic sourcing, product harmonisation, and make vs. buy analysis. These initiatives led to significant cost reductions.

Additionally, the Procurement Organisation Assessment aimed to enhance MHL’s procurement capabilities. Recommendations included restructuring the team, enhancing governance, and improving strategy and systems.

Throughout the project, Curzon fostered a collaborative relationship with MHL, employing a unified ‘one team’ approach and acting as trusted advisors. A well-defined governance model ensured efficient communication and problem-solving.

Despite challenges such as supplier resistance and stakeholder reluctance to change, Curzon overcame obstacles through pragmatic approaches, evidence-based reasoning, and stakeholder management expertise. The project delivered measurable results, exceeding savings targets by 28%, with a sizeable in-year cash impact. Qualitative outcomes included improved transparency in spend areas, satisfaction with new products, and enhanced trust in the procurement team.

In conclusion, the partnership between MHL and Curzon Consulting exemplified resilience, innovation, and successful collaboration, resulting in significant cost savings and organisational improvements.

Chetan, Stephane and the Curzon team were contracted to deliver an optimisation programme at Marston Holdings. The Curzon team approached the complex task with energy and professionalism, which was key to the ultimate success of the programme.

The technical knowledge and capability of the Curzon team were clear from the start of the engagement and we had total faith in their capability to deliver the ambitious goals they had been set. Marston would recommend Curzon to anyone who requires the domain knowledge and experience of a capable consulting partner. We look forward to working with them in the future

Martin Johnson, CEO, Marston Holdings Ltd

Performance Improvement in the Public Sector with National Highways

Read More

Responding to the UK Government’s productivity challenge, National Highways (NH), in partnership with Curzon Consulting, is delivering a transformational 30% improvement in productivity and can realise a multimillion pounds in savings by 2030.

Over the past twenty years, the construction sector has struggled to demonstrate meaningful productivity improvements. NH set a challenging target of a 30% productivity improvement and a 5-10% cost reduction over Road Investment Strategy 2 (2020-25) and appointed Curzon as its strategic delivery partner.

Significant progress has been made over the last year (23/24). There has been an average of 30% productivity improvement across monitored assets, and the percentage of hours lost has been significantly reduced. This achievement demonstrates the robustness of the standardised systems and processes that have been developed and deployed.

Core enablement of the productivity improvement lies in the timely capture and reporting of performance via an innovative and interactive App, rolled out initially across the Tier 2/sub-contractor supply chain. This has enabled NH to make faster, informed decisions where there are significant variances to plan, enforcing greater accountability on the supply chain, identifying and specifying standards and best practices, and raising supply chain awareness of what good performance looks like. In turn, this has fostered greater collaboration between NH and its supply chain without requiring contractual amendments. Increased scheme predictability is tangible, with Tier 1s rebase-lining their schemes to include productivity improvements while modular design improvements and standardisation contribute additional value.

Creating and implementing a digital productivity app and dashboard has provided NH with a consistent stream of standardised productivity data and relevant context directly from the point of delivery. This has brought about a positive change in how NH and the supply chain collaborate. For the first time, NH PMs are engaging in conversations based on intelligence gathered from the dashboard. With weekly progress reports, NH can now access productivity data insights to scrutinise and challenge the supply chain, which was impossible before.

NH is using digital intelligence to collaborate with its supply chain, measure the productivity of key assets, and set improved productivity targets. They now have an efficient system for gathering, reviewing, and acting on productivity data. NH has developed a methodology to calculate productivity value and demonstrate efficiencies to the Office of Rail and Road. NH can now utilise the extensive productivity data for strategic procurement, commercial decision-making, and contracting.

The 30% target improvement is being achieved or exceeded on most asset classes, giving NH confidence that improved productivity in Road Investment Strategy 3 (2025-30) will translate into multi-million-pound benefits.

The Curzon team is making significant contributions. National Highways has been striving to set asset-level productivity baselines for over 10 years. The work we are progressing together is transforming how National Highways reviews project performance and is also beginning to inform wider industry Infrastructure Client Group.

David Bray, Programme Director, National Highways

CONTACT US TO FIND OUT HOW WE CAN HELP

UK’s Leading Management Consultants 2024

We are delighted to have been recognised again as one of the ‘UK’s Leading Management Consultants 2024’ by the Financial Times

Recommended across 11 categories an increase from 8 in 2023, the annual rating, compiled with data company Statista is based on endorsements by clients and peers. It demonstrates our consistent year-on-year sector and service line growth.

Consulting companies are awarded Bronze (recommended), Silver (frequently recommended) or Gold (very frequently recommended).

Sectoral Expertise

· Aerospace & Defence – Bronze

· Chemicals & Pharmaceuticals – Bronze

· Construction & Infrastructure – Silver

· Energy, Utilities & Environment – Bronze

· Financial Institutions & Services – Bronze

· Healthcare & Life sciences – Silver

· Public Sector – Bronze

Consulting Services

· Digital Transformation – Bronze

· Operations & Supply Chain – Silver

· Strategy – Silver

· Sustainability – Silver

Managing Partner Andrew Morgan said

The FT Awards are a humbling recognition of our company’s continued growth and as a direct result of our team’s talent and commitment. I’m deeply grateful for their unwavering dedication, incredible drive and ability to deliver outstanding results for our clients.

CONTACT US TO FIND OUT HOW WE CAN HELP

UK’s Leading Management Consultants 2023

We are delighted to have been recognised for the sixth consecutive year as one of the ‘UK’s Leading Management Consultants 2023’ by the Financial Times.

Recommended across 8 categories and with a Gold Award for the 2nd consecutive year, the annual rating, compiled with data company Statista is based on endorsements by clients and peers. It demonstrates our consistent year-on-year sector and service line growth.

Consulting companies are awarded Bronze (recommended), Silver (frequently recommended) or Gold (very frequently recommended).

Sectoral expertise

- Construction & Infrastructure – Gold

- Healthcare – Silver

- Financial Services – Bronze

- Public & Social Sector – Bronze

Consulting services

- Digital Transformation – Silver

- Operations & Supply Chain – Silver

- Strategy – Silver

- Sustainability – Silver

Managing Partner Andrew Morgan said

We are absolutely delighted to see the continued and consistent progression of Curzon. I am so proud of the team, as this emphasises their commitment and dedication to deliver sustainable, tangible results for our clients through strategic, operational and transformation delivery.

CONTACT US TO FIND OUT HOW WE CAN HELP

Recessions are easy to forecast, so how can CEOs better prepare to weather the economic storm?

‘A rising tide lifts all boats’ is an aphorism associated with the idea that good CEOs can drive business growth during the good times. However, in my experience…

exceptional CEOs drive remarkable growth during economic downturns!

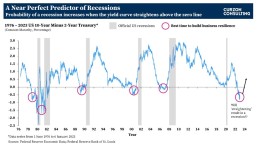

No matter what anyone tells you, recessions are easy to forecast. It’s the severity of the recession that is difficult to predict. One of the most watched charts in economics is the 10-year US treasury interest rates minus the 2-year US treasury interest rates (a.k.a. Yield Curve chart), which has a near-perfect record of forecasting recessions. The yield chart is currently flashing a ‘code red’ highlighting a recession is highly likely within the next 12-18 months. However, it is not all doom and gloom!

Smart CEOs can leverage the yield curve date to ensure their businesses are fortified to weather the upcoming economic storm. As shown on the chart, building financial and operational resistance should be a key priority of executives whilst the yield curve remains inverted!

What is yield curve inversion, and why does it matter?

To simplify… the chart shows the 10-year US treasury interest rates minus the 2-year US treasury interest rates. In a normally functioning economy, the longer the bond maturity, the higher the interest rate (yield) demanded by investors. Investors seek higher returns on longer maturing binds as risks become more difficult to anticipate the longer the term extends into the future.

However, when investors are worried about the economy, they get concerned with the ‘here and now’. Therefore, investors demand higher interest rates on short-term maturities; hence, an inversion between the 10-year and the 2-year interest rates takes place.

An inversion occurs when the 10-year US treasury interest rate minus the 2-year US treasury interest rate falls below zero.

Pre-1990s, recessions were recorded whilst the yield curves were inverted (i.e. below the zero line). Post-1990s, all recessions were recorded after the yield curves straightened (post the initial inversion).

As of 6th January 2023, the yield inverted at -0.69. This inversion is flashing a major warning signal! If history repeats again, there is likely to be a recession once the yield curve straightens again.

The question is… how deep will the recession be? That’s hard to forecast, but the current inversion rate is much deeper than what we’ve post-1990. If the inversion continues to deepen similar to the early 1980s, we could potentially see a large recession following.

So what?

As highlighted on the chart, the best time to start a business transformation programme and build financial and operational resilience is when the yield curve is inverted and well BEFORE it straightens again (i.e. rises above the zero line).

CEOs and CFOs should utilise the yield curve chart to kick start or accelerate an existing business transformation programme, well before a recession arrives.

If you are interested in learning more, please get in touch

CONTACT US TO FIND OUT HOW WE CAN HELP

Reimaging Radiology Equipment Maintenance Models - How to Enhance Cash Flow and Drive Inflation Busting Savings

With inflation at a 40-year high, how can large, multi-site operators of diagnostic equipment achieve transformative savings whilst maintaining quality?

According to Mordor Intelligence, the UK diagnostic imaging equipment market is estimated to be USD 1.1 billion in 2022 and is expected to reach USD 1.5 billion by the end of 2027.

Our research highlights, the typical profit margin on new diagnostic equipment such as a PET (Positron Emission Tomography), MRI (Magnetic Resonance Imaging), CT (Computed Tomography), Fluoroscopy, Ultrasound, X-Ray, etc... is 10-15%. However, the profit margin on maintenance contracts is > 35%.

The typical annual maintenance cost of an MRI scanner is £50,000-£70,000 and CT Scanner is £30,000-£50,000. The sum cost of all the individual maintenance contracts can mount up very quickly to several million pounds!

The actual cost of a maintenance contract can vary depending on volume discounts, hours of operation, uptime guarantees, and scope of what is included or excluded inclusions – coils, helium, etc…, along with other cost drivers.

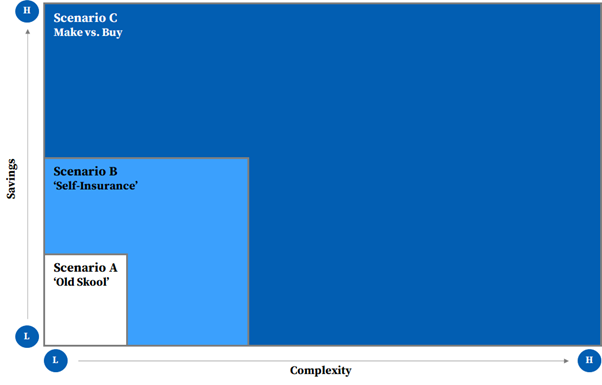

We believe there are 3 key operating models with each one driving a progressive level of savings. Scenarios B and C deliver transformative, inflation busting savings, but are the most complex to implement.

Savings vs. Complexity

Over the past few years, some organisations have turned to third-party maintenance service providers as an alternative to traditional Original Equipment Manufacturer (OEM) warranty and post-warranty support. This move has yielded substantial savings. However, that is just one solution amongst a range of others.

Scenario A – ‘Old Skool’

Under Scenario A, an organisation negotiates a full-service, gold-standard, maintenance contract with an OEM or third-party maintenance service provider.

‘Old Skool’ model can generate 10-15% savings.

Scenario A works well for a single or small hospital / diagnostic service provider business. For a large private hospital group or a diagnostic imaging service provider, this model is ‘old skool’, and worst of all, the buyer transfers significant value to the seller.

For organisations that operate a larger portfolio of diagnostic equipment, where there is a critical mass, our extensive and deep understanding of the market shows two alternative models. Both models require an open mind and can be explored together to ‘turbo-charge’ saving.

Scenario B – ‘Self-Insurance”

Under Scenario B, an organisation leverages a ‘self-insure’ model where it adoptings a risk management technique in which the company accrues a ‘pool of money’ to be used to remedy an unexpected loss from equipment breakdowns. Organisations can self-insure against equipment breakdown, and mitigate risk of large unforeseen losses by taking out implementing an excess insurance policy.

Under this scenario, an organisation buys a preventative maintenance (PM) only contract from an OEMs (Original Equipment Manufacturers) or third-party maintenance service providers, with a pre-negotiated price list for parts. The organisation pays for breakdowns as and when needed from accrued funds.

If risk is –managed appropriately, organisations can significantly enhance cash flow and savings.

‘Self-insurance’ model can generate 15-25% savings.

Scenario C – ‘Make vs. Buy’

Under Scenario C, an organisation makes a ‘make-or-buy’ decision where it chooses between setting up an in–house maintenance organisation (people, process, and systems) versus purchasing the service in part or whole from an OEM or third-party maintenance service provider.

‘Make versus buy’ model can generate 25-40% savings.

Under both Scenarios, an organisation can decide to carve-out some or all types of the diagnostic equipment for self-insurance, based on a risk assessment of service levels and uptime guarantees required per site or department.

The additional savings can be used to reinvest in new equipment, upgrades and/or drive digital transformation programmes to enhance productivity of the radiology department and improve administration, technician, clinician and patient experience.

Failure to get this right can have a material, knock-on impact on operations, patient and clinician experience, and a material loss of revenue whilst a machine is out of use.

How Can Wwe Help?

We have developed a deep understanding of the diagnostic imaging equipment market. We help clients to challenge the status quo and drive transformative benefits via the successful implementation of Scenario B and/or Scenario C.

For Scenario B – ‘Self-Insurance’, we have a methodology and proprietary analytics tools that allow us:

- accelerate the evaluation of a ‘Self-Insurance’ model

- assess financial treatment of accruals

- design options based on risk tolerance of the business

- develop a business case

- develop management information dashboard to monitor and track solution

- implement solution

For Scenario C – ‘Make vs. Buy’, we have a methodology, proprietary analytics tools and experience designing in-house operating models, that allow us:

- accelerate the evaluation of a ‘Make vs. Buy’ model

- perform maintenance demand analysis by geography

- design new Target Operation Model (TOM) options for the ‘Make’ solution

- develop a business case

- develop implementation and risk mitigation plan

- embed new TOM within an organisation

If you are interested in learning more, please contact me at chetan.trivedi@curzonconsulting.com.

CONTACT US TO FIND OUT HOW WE CAN HELP

2022 MCA Awards Winners

We are so very proud to announce #CurzonConsulting, has won the Commercial Impact #mcaawards 2022 award, with #RamsayHeathCare. Representing the very best of our consulting business, it’s such an incredible achievement to be recognised for our Procurement Transformation Programme. The judges said this was a team that: “brought specific expertise to a problem and rebuilt the procurement capability at speed, changing hearts and minds in the organisation.”

Established by the Management Consultancies Association, the representative body for the UK’s leading management consulting firms, the #MCAAwards demonstrate the transformational work the sector has undertaken during the last challenging twelve months.

The remarkable achievement marks the eight consecutive years that Curzon Consulting has been a finalist at these prestigious awards.

Commercial Impact: Procurement Transformation Programme with Ramsay Health Care UK

Ramsay Group operates a global network of 530+ healthcare facilities across 11 countries.

The pandemic exposed an over-reliance on a ‘single’ income source. With all elective activity (e.g., joint replacements, cataracts), the primary income source, halted overnight, but a high fixed cost base remained.

As a response, Ramsay UK embarked on an ambitious growth & efficiency programme. Curzon was engaged to design and deliver a Procurement Transformation programme.

Over 9 months, we took a pragmatic, agile and “together” approach to accelerate benefit delivery, particularly in high spend / high complex clinical spend categories.

By assessing the existing PO against a methodical and objective review against 8 dimensions we highlighted several data-driven insights; fundamentally, the PO only managed 44% of total spend; hence lack of PO involvement resulted in suboptimal category /supplier management and savings delivery.

Improvement opportunities were incorporated into the design of the new Procurement Organisation.

Our methodology was specifically adapted to address demand-side cost optimisation levers.

Through a deep dive into orthopaedics, a key benefit delivered in Orthopaedics came from ensuring the Surgeon selected the appropriate implant system (metal or ceramic) to match the patient’s profile (e.g., age, gender).

A well-established norm in Orthopaedics is to routinely implant, high quality, lower-cost metal vs. ceramic hip systems into >70-year-old patients. Our analysis showed Surgeons at Ramsay UK implanted costly ceramic hip systems in 33% of >70-year-old NHS patients. The NHS reimbursement for a complete hip replacement is fixed, so every incremental switch from ceramic to metal impacted the bottom line.

Surgeons had little comprehension of how their hip selection decisions impacted Ramsay UK’s profitability. Our insights directly influenced the Orthopaedic Steering Group’s new policy which required Surgeons to utilise lower-cost metal hip systems in older NHS patients.

Curzon established an open, trusted, and collaborative way of working with the Ramsay team, and by adopting a “one team” approach with the PO we ensured everyone involved with the procurement transformation owned the outcome and maximised the benefits from knowledge transfer during Wave 1.

Fundamentally a key part of the relationship was to ensure recommendations on cost improvement would not compromise clinical outcomes and patient satisfaction.

Wave 1 has delivered £multi-millions in incremental annualised savings. In addition, the savings have translated into several £100 million worth of shareholder value.

Commenting on the success – Ramsay Health’s CFO Peter Allen said:

“Curzon helped us obtain the confidence and operational ‘can-do’ to drive incremental savings sooner than we could have expected, and then to push on to best practice performance.

Their skill was in balancing pace of change and the results imperative with the need to take the organisation with them on the journey. A key achievement was building the necessary collaboration between the many functions that needed to act together to drive benefits in complex clinical spend categories.

Curzon’s strong analytical expertise, and ability help us to take a critical view on the “art of the possible” and bring the team along on the journey to demonstrate benefits delivery was a critical success factor.

The result was a tangible and ongoing commercial win, and a new Procurement Organisation to drive cost leadership, profitability and sustainability going forward”

A massive congratulations to the Curzon Consulting team and Ramsay Health Care UK and the other finalists.

CONTACT US TO FIND OUT HOW WE CAN HELP

We are delighted to welcome a new Partner for Financial Services Sector!

Curzon Consulting has appointed Andy Stewart as Partner – Financial Services, starting in October.

Andy will help drive the strategy in the financial services market, which is core to Curzon’s growth plans for the future. Working with Douglas Badham, Partner & Financial Services Sector Lead, Andy will be responsible for developing new and innovative propositions and go-to-market approaches as well as managing some of Curzon’s long-term client relationships.

Andrew Morgan, Managing Partner, Curzon said: “It’s fantastic that Andy has joined the team. He brings a wealth of background and experience that will help us add even more value to our financial services clients”

Douglas Badham, Partner & Financial Services Sector Lead, Curzon said: “I look forward to working with Andy as his expertise and strong client relationships will be invaluable to us as we execute our growth strategy”

Andy Stewart, Partner – Financial Services, Curzon said: “I’m excited to be joining the team at Curzon as they have long been committed to outstanding client service and the delivery of tangible results for their clients. I’m looking forward to getting started”

CONTACT US TO FIND OUT HOW WE CAN HELP

CIPS Awards Winners

Last night at the CIPS Excellence in Procurement Awards, we won “Best Procurement Consultancy Project of the Year” for our collaboration with Ramsay Health Care UK.

Congratulations to both teams!

Procurement Transformation Programme with Ramsay Health Care UK

As a pandemic response, Ramsay UK embarked on an ambitious growth & efficiency programme. Curzon designed and delivered a substantial cost reduction and Procurement Transformation programme.

Over 9 months, we defined a pragmatic and agile approach to implementing a best-in-class procurement organisation with an increased mandate, able to accelerate benefit delivery, and manage high spend / high complex clinical spend categories.

We helped Ramsay UK to deliver £multi-millions in incremental annualised savings. In addition, the savings have translated into several £100 million worth of shareholder value.

View the full case here – https://www.curzonconsulting.com/procurement-consultancy-project-of-the-year-ramsay-healthcare/

CONTACT US TO FIND OUT HOW WE CAN HELP

UK’s Leading Management Consultants 2022

We are delighted to have been recognised for the fifth consecutive year as one the ‘UK’s Leading Management Consultants 2022’ by the Financial Times.

Recommended across 8 categories and with our first Gold Award, the annual rating, compiled with data company Statista is based on endorsements by clients and peers and demonstrates our consistent year on year sector and service line growth.

Consulting companies are awarded Bronze (recommended), Silver (frequently recommended) or Gold (very frequently recommended).

Sectoral expertise

- Construction & Infrastructure – Gold

- Financial Services – Silver

- Public & Social Sector – Silver

- Healthcare – Bronze

Consulting services

- Digital Transformation – Silver

- Operations & Supply Chain – Silver

- Strategy – Silver

- Sustainability – Bronze

Managing Partner Andrew Morgan said

We are absolutely delighted to see the continued progression of Curzon, competing alongside some major consulting brands. I am so proud of the team, and this emphasises their commitment and dedication to deliver tangible results for our clients in a range of markets through strategic, operational and transformation delivery.